Santee Cooper execs appear before state commission

Last week, Santee Cooper finally got their day in court. Interim President & CEO James (Jim) Brogdon, Jr. along with General Counsel Mike Baxley, CFO Jeff Armfield and Senior Vice President for Corporate Services Pamela Williams appeared before the General Assembly’s Public Service Authority Evaluation & Recommendation Commission to update the legislature on the state of their agency and to be cross-examined by a panel that included the Governor himself.

To summarize the nearly five-hour session briefly: it was a 50-50 mixture of charm and alarm.

First the charm.

Santee Cooper clearly wanted to plant in the minds of the Commissioners that they weren’t taking themselves too seriously, which might have gone a step too far (see winking CEO Brogdon above).

Santee Cooper also sought to portray a civic-minded, not profit-oriented agency being run by good, patriotic South Carolina people with many years of exemplary service to the state. The V.C. Summer meltdown? It was nearly unavoidable, at least for Santee Cooper, and because of their sound management going forward, it will have little effect on ratepayers.

Nothing to see here.

Then there was the alarm angle. Disaster could be just around the corner if Santee Cooper were tinkered with: ratepayers could be on the hook for converting current Santee Cooper debt to more expensive private debt, the bond counsel for Santee Cooper could become jittery about repayment and demand that the state step in to protect the bondholders, property owners near Santee Cooper lakes could see their taxes rise due to a change in ownership, and splitting up Santee Cooper for sale purposes could run afoul of the terms of current outstanding bonds.

All of these are what rhetoricians call “straw men,” obstacles that appear to be formidable but are actually surmountable. (We will provide more details on these straw men in a future post.)

What is not easily surmountable in the near future is the Santee Cooper debt.

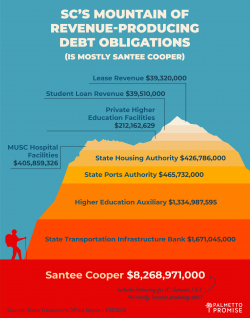

We illustrate this with the graphic below showing a section of a recent report released by the South Carolina State Treasurer’s office. The full report is entitled Annual State Debt Report: An Overview and Summary of South Carolina Debt Outstanding, Limitations, Constraints, and Capacity.

One section of that report is called “Revenue Debt,” or “indebtedness for any public purpose payable solely from a revenue-producing project or from a special source.” Examples of this shown in our graphic are colleges, who may float bonds to build buildings and then pay back the loans over time from student fee revenue. Or the Transportation Infrastructure Bank, who could authorize road projects and pay back the funds from fees, like those on trucks using interstates.

Then there’s Santee Cooper. At $8,268,971,000, its indebtedness is over 60% of all state indebtedness of the revenue-generating kind. Yes, ratepayers will be there to provide that revenue, but the V.C. Summer portion of that $8 billion couldn’t exactly be called a “revenue-producing project.”

With no shareholders, a state agency has only one place to turn to pay debt. That is the real cause for alarm that can’t be charmed away.