Statehouse Report: State revenue projections might be off by $350 million

PPI CEO Ellen Weaver is featured in a story from the Statehouse Report regarding South Carolina’s higher-than-expected incoming revenues.

By Lindsay Street, Statehouse correspondent | Funding of pet projects at the Statehouse is coming from a surprising source: conservative revenue projections.

State lawmakers likely will get a windfall next year of up to $350 million in unforecasted, new revenues. This pool of money was not available for 2019-20 budgeting thanks to conservative revenue projections still in place since the Great Recession. As such, House budget writers predict the pot of money likely will be spent on one-time expenses instead of long-term projects.

Next week, the state’s budget prognosticators will discuss how revenue projections may be missing the mark.

“It’s a good thing on one hand, and a bad thing on the other because $350 million — everybody gets dollar signs in their eyes … and very rarely do we spend it in a way to impact serious issues in our state,” House Ways and Means First Vice Chair Gilda Cobb Hunter, D-Orangeburg, said.

Think of it as a family finding extra money at the end of the year because it underestimated its income, and deciding to put the extra money toward singular, isolated expenses like visiting the grandparents, buying a big TV or putting tires on the car. The family, however, has ongoing long-term expenses that could use those dollars — things like the retirement account or paying the babysitter.

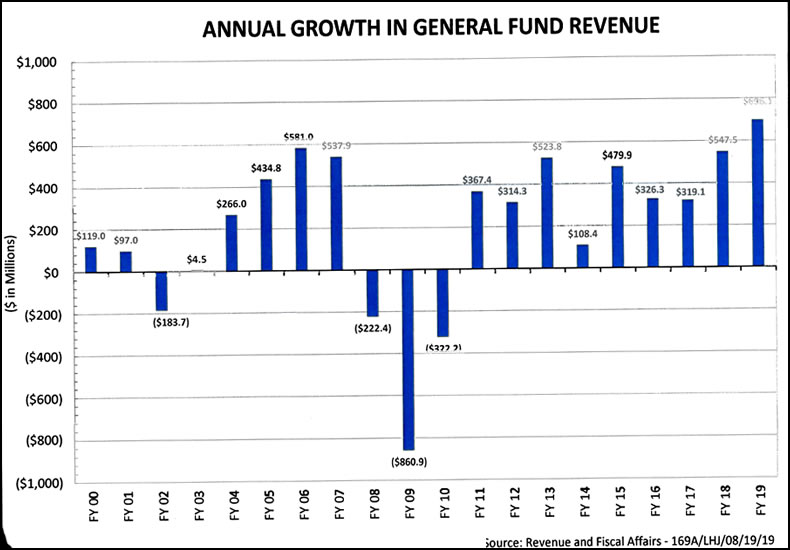

According to Frank Rainwater, executive director of the S.C. Revenue and Fiscal Affairs Office, South Carolina’s revenue forecast has been off by 2 percent and 4 percent over the last two years, which accounted for a $177 million surplus in the 2017-2018 budget and a $350 million surplus the following year.

The extra money in 2018 was packaged into the 2019-2020 budget as nonrecurring revenue (which is only used once), and the House’s lead budget writer says he wants to do the same for 2019’s surplus in the 2020-2021 budget.

The higher than expected revenues are bringing a spotlight on how lawmakers draft their annual state spending plan. On Monday, the state’s four-member Board of Economic Advisors will convene to discuss the success of revenue projections from the 2018-2019 budget. Rainwater will make a presentation at the meeting, which begins 1:30 p.m. in room 417 of the Rembert Dennis building on the Statehouse grounds in Columbia.

‘More of an art than a science’

House Ways and Means Chair Murrell Smith, R-Sumter, billed the 2019 surplus as a “good thing.”

“It’s hard to predict the strength of our economy right now, and (the BEA is) trying their best, but they also need to do it conservatively,” he said. “(Critics) need to look back to after the Great Recession where they were constantly overestimating the revenue streams in South Carolina. We were having mid-year budget cuts … You’d much rather they underestimate rather than overestimate.”

Rainwater said his agency is still using the same, imperfect methodologies that led to deficits after the 2008 recession.

“(It) may be more of an art than a science, sometimes,” he said. He added that the forecast’s goal is to be within 1.5 percent of the actual revenues. “We rely on historical relationships between the economy and state revenues, but those are averages and they don’t necessarily play out the same every year … (and) there are no hard and fast relationships between growth and tax revenues. There’s always normal variations.”

The biggest factor leading to the 2018-2019 surplus was the “largest increase” in state revenues: $696 million, according to Rainwater. He said that was due to several “unusual events,” such as unexpected tax revenues from a $1.5 billion U.S. Mega Millions winner, two state audits that recovered $16 million, and changes that allowed the state to collect millions of dollars internet sales tax. There has also been revenue increases in “very volatile sectors,” such as corporate income with increases of $100 million in state revenue each of the last two years, Rainwater said.

The final numbers for the 2018-2019 revenues will be reported at Monday’s meeting.

Smith said he’s not eyeing any fix for improving the state’s budget forecasting. Cobb Hunter said that, if possible, forecasting dates could be adjusted to make them more timely. As it stands, the BEA releases forecasts once a quarter, and lawmakers are working off of projections that look nearly two years out.

“Part of that may not be able to change, but it’s something that should be looked at,” she said.

How to spend millions

Meanwhile lawmakers are facing a second year of deciding how to spend an unexpected windfall.

There are at least two options: spend the money in a supplemental appropriations bill (fancy talk for budgeting the money into this current fiscal year) or adding it into the non-recurring revenues for the 2020-2021 budget year. Smith and Cobb Hunter both agreed that the latter is the likely and better option.

In the 2019-2020 budget, the previous year’s $177 million revenue surplus was among the $1 billion extra the state included in its non-recurring revenue. Some of that went to a $50 per-household income tax refund and a bonus for state employees. Some of the money also went to smaller, more local projects such as millions to the South Carolina Aquarium, the Greenville Cultural and Arts Center and the Saluda River Greenway.

When announcing the 2017-2018 and 2018-2019 surpluses, Comptroller General Richard Eckstrom pushed for lawmakers to put the money toward funding state employee pensions, which stood at $25.47 billion shortfall at the end of fiscal 2018. That didn’t happen last year, and it probably won’t happen again this year.

“We already have a plan where we are increasing revenue every year for pension reform,” Smith said. “We are contributing every year more recurring revenue to reduce the unfunded liability.”

S.C. State Employees Association Executive Director Carlton Washington said the state should consider making state employee pay more market-competitive to help core functions of government have a stable staff. He said all options should be on the table, including the surplus. State employees saw some movement in their pay in the recent budget, but Washington said it hasn’t been enough to stave off instability at state offices. He called on lawmakers to enact “meaningful” changes.

Tax reform advocate Ellen Weaver of the Palmetto Promise Institute said the surplus shows the state can handle big changes — such as lowering rates and broadening the base — in revenue collections. Weaver added current budgeting practices need to be addressed.

“Our budgeting trends in South Carolina tend to mirror the cycle of the economy, when we make more, we spend more, and when we make less, we spend less, and that’s not a sustainable way to fund our budget,” she said.

Smith and Cobb Hunter urged caution for fellow lawmakers on spending the $350 million surplus in the 2020-2021 budget.

“Most economists are predicting a slow down in our economy,” Smith said. “We need to take a deep breath and see where our economy is going. We may need it for reserves.”

“I don’t think we need to take this surplus and create new spending,” Cobb Hunter said.