10 Frightful Facts about South Carolina Taxes

With Halloween just around the corner, what better time to horrify you with some scary facts about South Carolina’s old, broken tax system. In fact, it’s so rag-tag, we couldn’t help but wonder if it might be a long-lost cousin of The Mummy!

Over time, our tax base – income, sales and property – has eroded due to many factors, but largely because of a Frankenstein-like hodge-podge of legislative exemptions.

More exemptions mean that the people and goods left are taxed at higher and higher rates to keep the lights on. And this creates a frightfully growing unfairness between those who pay and those who don’t.

Which means that even more people ask for exemptions…which leads to higher rates…which leads to more unfairness…you get the idea. South Carolina is currently stuck in the dreaded INFINITE LOOP!

Not scared yet?

Here are 10 more hair-raising facts:

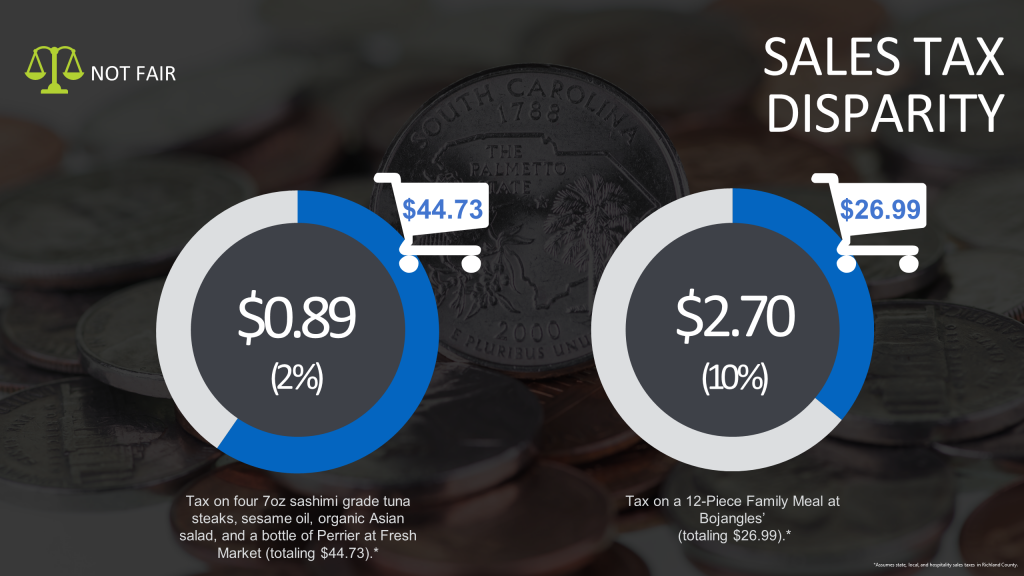

- South Carolina doesn’t tax groceries – whether you’re buying ramen noodles or filet mignon. But in some counties, you’ll pay up to 10% tax on prepared food!

- 41% of taxpayers are subject to the highest marginal income tax rate in the Southeast: 7%.

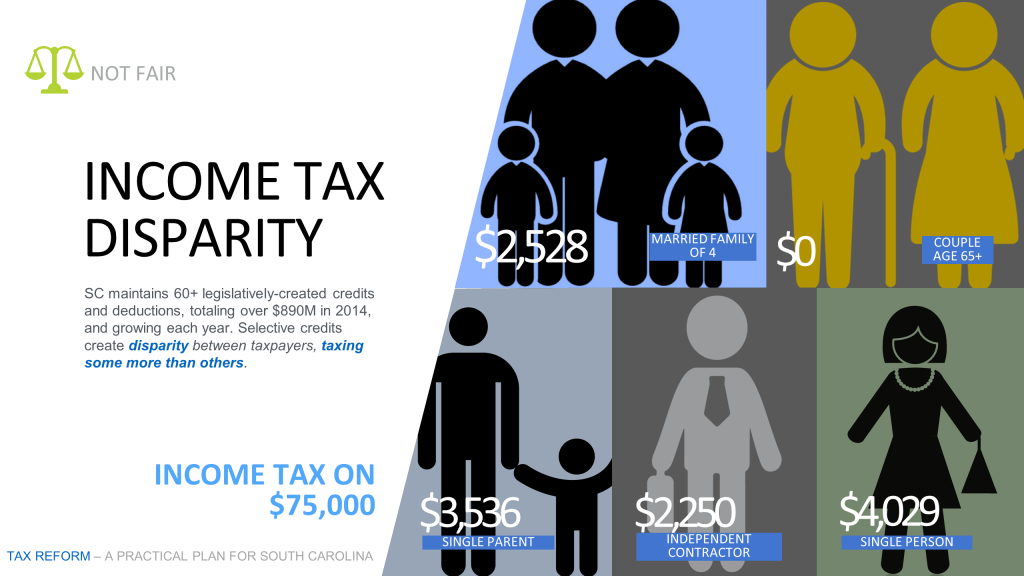

- Selective exemptions create big inequalities, making the income tax burden (on the same amount of income) much higher for some than others.

- Since 1993, property taxes have increased 31% in real dollars.

- Renters and small businesses pay up to 3 times more property tax than homeowners.

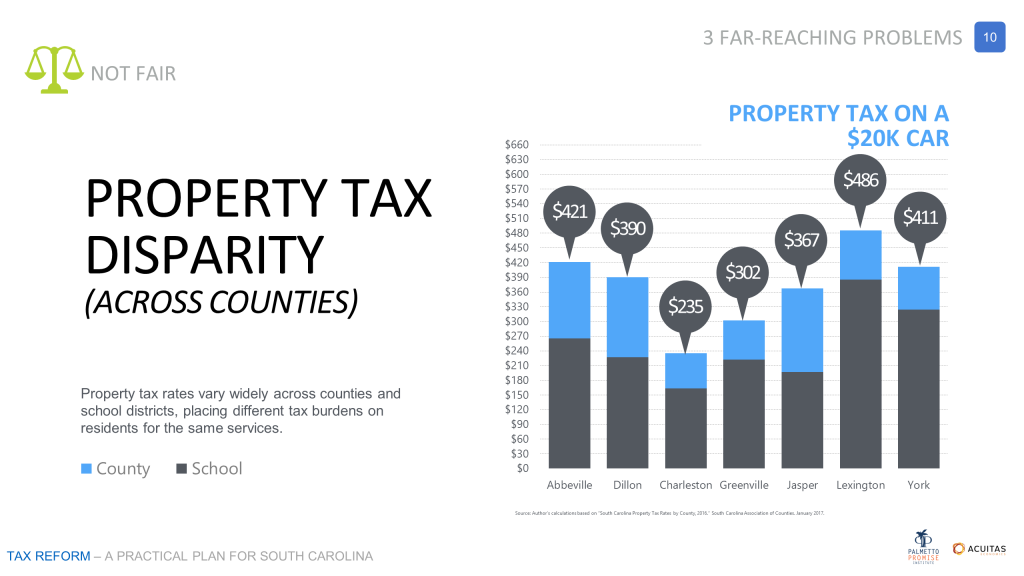

- Property tax (on the same good) is HUGELY unequal from county to county.

- South Carolina has the 6th highest auto property tax in the country.

- When comparing the largest cities in each state, Columbia has the #1 highest industrial tax rate in the nation. Runner-up? Detroit, Michigan.

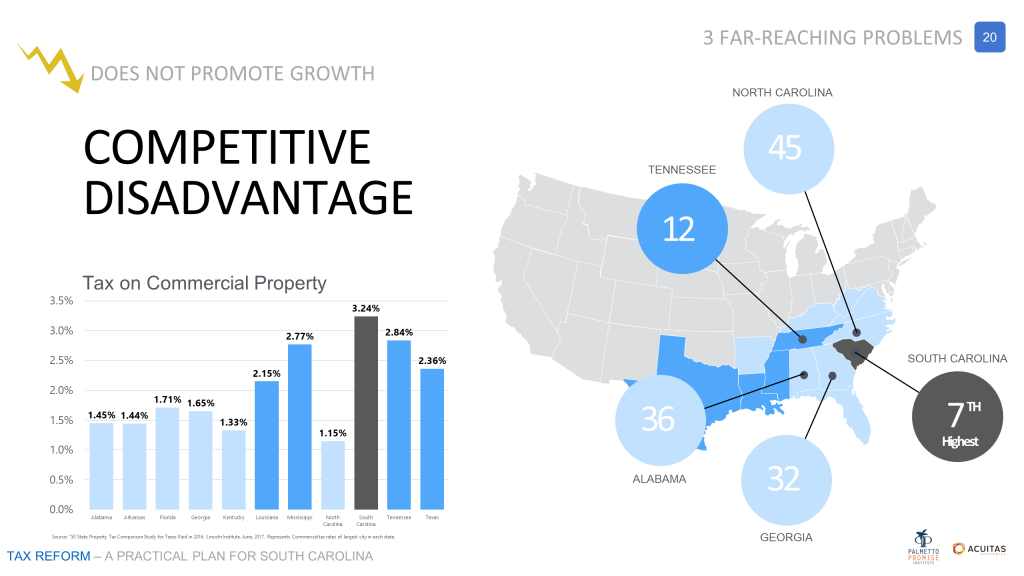

- South Carolina has the 7th highest commercial property tax in the nation…and the HIGHEST in the Southeast.

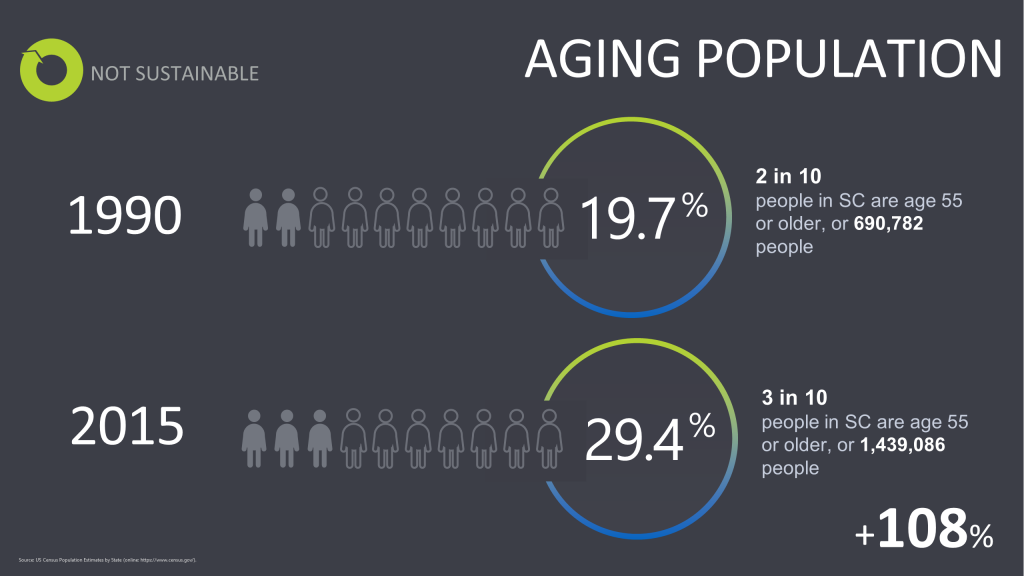

- South Carolina’s population is both growing (41% increase since 1990) and aging. This means more need for services and infrastructure…but with a proportionally shrinking tax base to pay for it because of special exemptions.

What does it all add up to? A tax code that is unfair, unsustainable and uncompetitive with our neighbors. Dracula himself would be impressed with the speed at which South Carolinians’ wallets are being sucked dry!

It’s long-past time for broad-based tax reform that lowers rates and protects YOUR hard-earned cash. Learn more about what we’re doing to make reform a reality…that is, if you’re not too scared!