A Tax Day Reminder: Cut South Carolina’s Income Tax

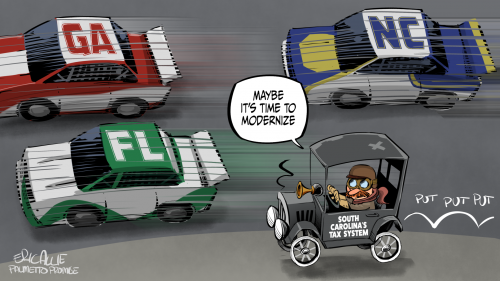

As Tax Day rolls around once again, Palmetto State residents are painfully reminded that—when compared to our Southeastern competitors—South Carolina currently takes home the trophy for “highest personal income tax rate”… a whopping 7%.

Meanwhile, our neighboring states have been on the move to modernize their tax systems.

Over the last 8 years, North Carolina has systematically cut their income tax rate and now boasts the lowest rate in the Southeast at a flat 5.25%. Georgia recently came off pit row and joined the race to lower their rates. Meanwhile, Florida doesn’t tax income, and Tennessee has no income tax and recently voted to phase out their “Hall tax” on interest and dividend income.

As our neighbors continue to tear up the track, it is critical that Palmetto State lawmakers put their foot on the gas if we are to have any hope of keeping South Carolina competitive and protecting hard working taxpayers.

While COVID has derailed or delayed many things, with state revenue projections continuing to rise, cutting South Carolina’s highest in the Southeast personal income tax rate should not be one of them.

For years, PPI has outlined the urgency of creating a tax system that is stable, competitive and fair. Read more here:

Not so happy Tax Day for Palmetto State residents

SC’s tax dilemma: unfair, unstable, uncompetitive

A Tar Heel tax lesson for South Carolina

House committee receives plan to make South Carolina competitive with southeastern neighbors

SC tax reform should begin and end with one thing: fairness

New poll shows South Carolinians’ support for comprehensive tax reform