Benefits outweigh risks in selling Santee Cooper

On July 31, 2017, Santee Cooper and SCE&G announced that they were abandoning work on the expansion of the V.C. Nuclear Station in Fairfield County. Shortly thereafter, Palmetto Promise went to work digging into the financial and policy implications of that decision for taxpayers and ratepayers.

PPI has stayed true to our research mission, providing an independent, scholarly analysis of hard numbers (most pulled directly from Santee Cooper reports), showing both graphically and analytically what was happening at Santee Cooper and why the state needed to get out of the electricity business.

Soon it became obvious that the Governor and the SC House of Representatives were ready to sell if the price were right. The Senate, blessed (or burdened depending on your perspective and the given issue) with rules that empower a small minority, called for a more detailed process. According to their plan, which the House ultimately agreed to, the state Department of Administration would spend the summer of 2019 coming up with three recommendations: a buyer, a manager and a reform plan. The results were reported last month with NextEra (Florida) winning the buyer competition, Dominion (Virginia) winning the management bid, and Santee Cooper presenting a reform plan it produced.

Nearly two weeks ago, the Senate and House returned to form. The Senate Finance Committee seemed to throw in the towel on sale and expressed its intention to appoint a committee to develop Santee Cooper “Reform” legislation. The House Ways & Means Committee, with the active participation of the Speaker, began the process of sending to the House floor a resolution that will seek to get a better deal from NextEra while at the same time stating specific reforms it would require should the sale effort fail. (PPI testified to the House Committee, but the Senate did not take public testimony).

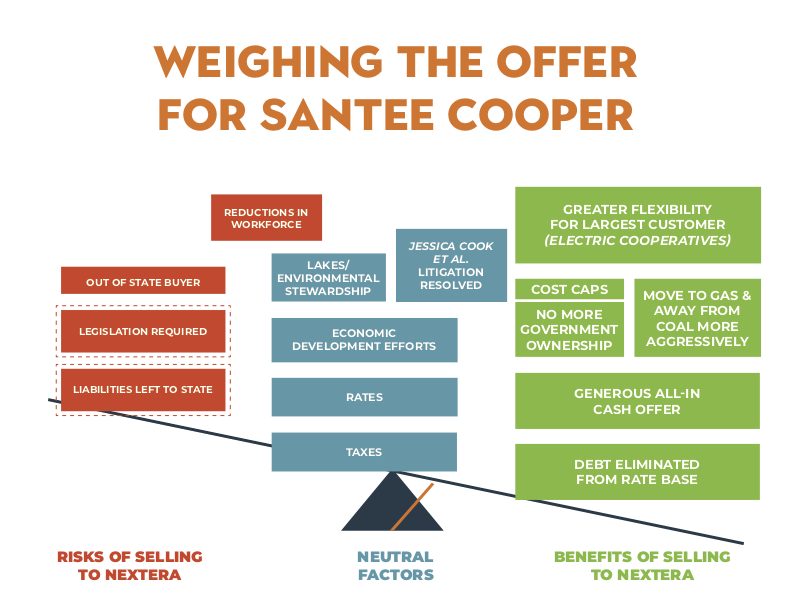

A look at the scale tells the story.

The Risks of Selling to NextEra are few. The original bid called for reductions in force, special legislation to define its generation mix and financing, and leaving some liabilities for Santee Cooper litigation and pensions with the state. Thanks to the work of the SC House, all of those risks are on the table for discussion with NextEra. (The risk of an “out of state buyer”? That may not be a legitimate risk, but some in the legislature just don’t like “outsiders.”)

Other factors are just as we label them—Neutral—meaning with either sell or reform, they would be the same. The Jessica Cook class-action legislation, lake access, environmental stewardship, economic development efforts, electricity rates, and state and local taxes would take care of themselves either way. (Rates were hotly debated, but in the end nearly everyone’s models showed them to be about the same whether NextEra or Reform.)

Then there’s the overwhelmingly positive Benefits of Selling to NextEra side of the scale. With a sale, the massive $6 billion in debt would go away (as well as the interest), the state would be out of the energy business and be provided a significant amount of cash with an over $9 billion all-in offer, and cost caps would be in place the first four years. (After that, the Public Service Commission would set rates through “rate cases” just like it does for Duke and Dominion.) Also with a sale, the new “Santee Cooper Power and Light” would move harder away from coal and stronger to natural gas than Reform, and the electric cooperatives would finally have a true partner rather than a “take it or leave it” one.

The next step? That is uncertain. If the two chambers stick with their current positions, two very different versions of a Joint Resolution could be headed to a conference committee. In any case, Palmetto Promise will be in the discussion, separating smoke from substance and providing facts and analysis to help guide the public and the General Assembly in a pro-free market, pro-South Carolina direction that protects ratepayers and taxpayers.