The Dollars That Saved Dollar General

Welcome to the Dollar General Distribution Center in Jonesville, South Carolina where honking fork lifts, the steady rumble of 13 miles of conveyor belts and hearty “hellos” from employees are sure to greet you.

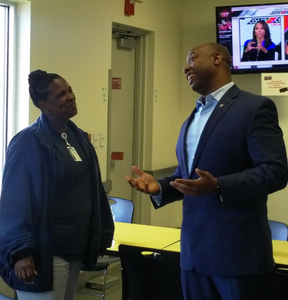

This week, U.S. Senator Tim Scott visited this hive of activity. His goal: to meet the people directly impacted by the policies and regulations coming from Washington.

A “Big Company of Little Stores”

From a single store opened in 1939 to the over 13,000 “neighborhood general stores” open today, Dollar General has become one of the nation’s fastest growing small-box discount retailers.

Founded in Scottsville, Kentucky, a rural community of only 4,300 people, the store has never forgotten its roots in small town America. Today, approximately 70% of their stores serve communities with populations of less than 20,000. Their decision to locate in Jonesville was no accident: they knew they could be a big part of this little community.

Co-founder J. L. Turner believed in the value of “keeping things simple in serving our customers.” Accordingly, he priced things with whole dollar amounts to allow customers to calculate their bills using basic math skills. He knew his core customers were people who fight hard every day to make a living and he was determined to empower them with good deals to provide for their families’ needs.

Although he became a successful businessman, J. L. was functionally illiterate with only a 3rd grade education. Today, in his honor, Dollar General operates a foundation to “open doors for personal, professional and economic growth” through the power of literacy. Since 1993, they have awarded more than $127 million in grants to help more than 4.8 million people learn to read, get their GED or learn the English language.

Right here in South Carolina, this employee-run foundation has given over $800,000 to 200 organizations, a fact that prompted Senator Scott to thank them for their philanthropic heart and for championing causes that make a real difference for people in the Palmetto State.

“Miss Dollar General”

But of course the store’s impact extends to the 481 stores and 4,900 people they employ around the state. One of those employees is Teen, a native of Jonesville and one of the Distribution Center’s original hires when it opened in 2005.

Reflecting back on how she came to Dollar General, Teen recalled driving by the massive building every day and wondering if an opportunity might await her inside. She remembers walking into a hiring fair held at the Union National Guard Armory during the last hour of the last day of the fair…and just a few days later on April 1, 2005, starting her new job as a Case Pack Supervisor in the then-nearly-empty building.

Through hard work and personal initiative – like volunteering to work 2nd shift – Teen was promoted up through the ranks to be an Inventory Control Supervisor. On October 15, 2015 – she remembers the exact date – she was promoted yet again to her current position of Inventory Control Manager for the entire facility, where she now controls every pallet in the 1.2 million square foot building.

She also supervises twelve Cycle Counters who are responsible for doing a complete building inventory every three months: quite a feat when you consider that the center services over 1,100 stores around the Southeast and packs between 13,000-21,000 cartons of merchandise every hour!

When asked what it means to her to be able to work a great job in her hometown, Teen says, “It means everything!” She shares how proud she is to be part of a successful, growing company. In fact, her pastor calls her “Miss Dollar General” because she is always talking about how much she loves her company culture, the people she works with and the great things like Relay for Life, March of Dimes and more that they work together to do in their community.

Teen’s embroidered shirt declares her to be a “MENTOR,” a role she passionately embraces. At Dollar General she said she’s discovered, “You’re in charge of your destiny.” And she finds great satisfaction in helping her team learn the skills to achieve the same kind of success she has. She shares, “I love finding out what they want to do and helping people who want to grow with the company.”

Where Policy Meets Real People

Where Policy Meets Real People

And grow the company has. After hitting a rough patch in the early 2000’s, Dollar General was acquired by Kohlberg, Kravis & Roberts (KKR), a private equity firm. After taking the company private for several years, they successfully lead one of the most dramatic turn-around efforts in retail history, at the height of the Great Recession.

Since that time, Dollar General’s growth trajectory has remained strong, expanding from 8,500 stores to over 13,000 and creating at least 20,000 new jobs. And there are even bigger plans for the future.

But this success story wouldn’t have been possible without private equity, a type of long-term investment that aims to grow and strengthen struggling companies. In these arrangements, partners come together to put up both capital and sweat equity to create long-term profitability. If they are successful (and success is far from guaranteed) and eventually sell the partnership, part of the profit becomes known as “carried interest,” a complicated but important part of capital gains tax policy.

Last year in a bill considered by the Senate and in heated rhetoric on the Presidential campaign trail, Bernie Sanders and others suggested that additional taxes should be piled on these kind of partnerships, treating carried interest as income instead of as capital gains, changing the way that it has been classified by tax law for the last 100 years. The claim: it’s time to punish Wall Street “fat cats” and raise new federal revenue.

But who would really be punished by this policy? People like Teen whose jobs have been saved – or created – by private equities’ willingness to assume the risk on these investments that lead to long-term economic growth. According to economist Steve Moore:

“For at least 40 years, funding for venture capital in new enterprises and the rate of new business start ups has been inversely related to capital gains taxes. The higher the penalty on risk capital, the fewer new entrepreneurial ventures get started.

If we want to accelerate the next generation of Ubers, Groupons, Home Depots, and Googles, we need investors willing to put their money at risk, and if they are going to be taxed at 50 or 60 percent, they are more likely to take a pass.”

And the same holds true of private equity that invests in struggling existing businesses. Whether it’s complicated policy like how “carried interest” is taxed, “hours of service” rules for truck drivers, Dodd-Frank, Obamacare mandates or the pending Department of Labors overtime regulations, the real world impact is on jobs like Teen’s and her ability to provide for her family.

Speaking to the Dollar General employees, Senator Scott said there’s a shot now in Washington to “roll back a regulatory environment that’s corrosive to paychecks and allow more upward managerial mobility.” Let’s hope for the sake of workers in South Carolina that he’s right.