Feed the Pig

In our Palmetto Playbook, we decided to take on fiscal policy more aggressively. After all, what policy area is more crucial to the future of South Carolina than how the state handles its money?

Since then, we have been writing about fiscal responsibility regularly.

Thanks for your positive response!

Our Playbook look back at state budgets since 2002-03 found that when the General Assembly had money it spent it. But thanks to a generally strong economy, the legislature had been forced to tap contingency or “rainy day” funds to shore up the state budget only three times during in that period (2003-04, 2007-08 and 2008-09).

But, the Biden economy isn’t healthy. The $1 billion+ state budget surpluses could be a thing of the past soon too. Fiscal rainy days could be ahead.

So, are we ready? Have we saved enough as a state?

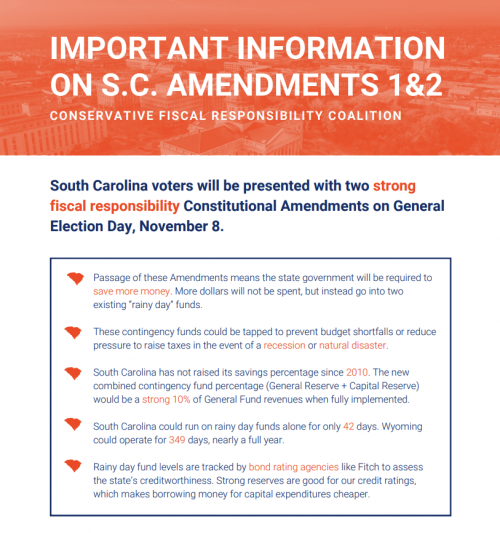

One of the measures of the adequacy of a rainy day fund is the number of days a state could operate its government on rainy day funds alone. According to Pew, the winner by that measure is Wyoming at a whopping 349 days. Nearly a year! South Carolina’s time span? 42 days.

Building up our reserves as a percentage of General Fund Revenue is the point of two Constitutional Amendments that will be on the ballot on November 8.

One raises the General Reserve Fund from 5% to 7%. The other raises the Capital Reserve Fund from 2% to 3%. If passed, the state will set aside a total of 10% of its General Fund Revenues for events like an economic downturn or a natural disaster when the new levels are fully implemented.

Contingency fund levels are tracked by creditworthiness rating agencies like Fitch, so feeding the piggy bank can also lead to lower rates for borrowing for capital projects like roads.

In order to educate the people of South Carolina about Amendments 1 and 2, five organizations have come together to craft the attached one-page analysis.

We hope it will be helpful to you. Share it with your friends!