Graphic: Just how high is that SC Individual Income Tax Rate?

Palmetto Promise Institute remains firm in our belief that when the Conference Committee working on the 2024-25 state budget faces the choice between cutting the state individual income tax rate and rebating a portion of the property tax, it should pick a permanent reduction in the individual income tax.

This is looking more doable with the recent announcement that the state is expected to have $143 million more in recurring revenue and $467 million more in non-recurring revenue for 2024-25.

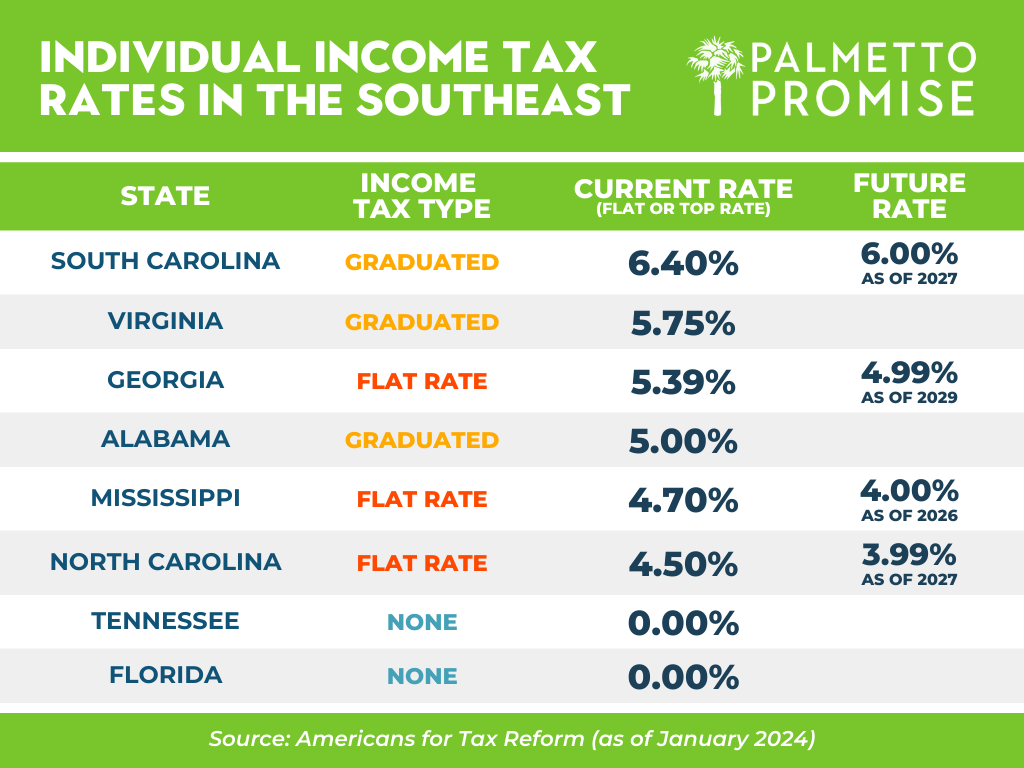

If a picture is worth 1,000 words, please consider the illustration below. As you will see, we still have a long way to go if we are going to get that top individual rate down to a level competitive with our neighbors.

The broader agenda for a state income tax is to have not only a low rate, but a flat rate that is indexed to inflation so that inflation doesn’t cause a tax increase. In 2022, South Carolina reduced the number of brackets, which flattened the rate. The state also indexed the brackets as a hedge against inflation. But the schedule for reducing the rate to 6% seems as slow as Christmas.

So, that means job #1 remains the same: reduce the rate!

The budget Conference Committee, made up of Representatives Bannister, Lowe, and Stavrinakis and Senators Peeler, Setzler, and Bennett, meets on Tuesday, May 28. We hope they will put South Carolina in line with the rest of the Southeast and speed up an income tax reduction for hardworking South Carolinians.