HELP NEEDED: Exceptional Needs Scholarships

A time-sensitive opportunity for YOU to help exceptional needs children in South Carolina has opened up. Individuals and companies may now donate up to 60% of their existing individual or corporate state tax liability. In addition to this dollar-for-dollar state tax credit, the contribution is also eligible for a federal income tax deduction.

These credits became available as of 9:30 a.m. Wednesday, July 6th and are given on a first come, first served basis until the current $10M program cap is reached. You or your accountant can learn more about the particulars of the process by clicking here. You may also contact the Department of Revenue at ExceptionalSC@dor.sc.gov or 803-898-5706 with questions or for more information.

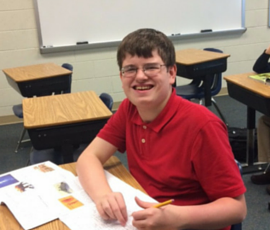

This is all part of a recent South Carolina program called the Educational Credit for Exceptional Needs Children (ECENC) that provides scholarships for children with special needs to attend approved private schools. Since its inception 4 years ago, the program has received growing, bipartisan support. Lawmakers have seen firsthand how children are being helped by getting into school environments best-suited to their individual needs: students like Cody from Greenville (pictured above) – who is making incredible gains at his new school, thanks to his Exceptional SC scholarship.

This legislative session, the program underwent some significant revisions, consolidating oversight and responsibility for the distribution of the scholarships to a special charity fund, established by the Department of Revenue and governed by a coalition of private school associations. This puts the program on firm footing for the future.

There are thousands of students like Cody who are counting on these scholarships for the Fall. Please consider this chance to designate money you’ll already be spending, in order to help them reach their full, God-given potential! And please copy and forward the following link to alert others who might have state tax liability that could support the future of these incredible young people.