Let’s Jumpstart Comprehensive Tax Reform

Since he was elected to the South Carolina Senate in 2012, Senator Sean Bennett has been a strong, steady voice for comprehensive tax reform.

Bennett is known for taking to the well of the Senate and laying out his very specific concerns about how our current tax code is unfair, unstable and uncompetitive. Two of his most articulate calls for change—in 2018 and 2021—were edited into short videos (one by Palmetto Promise). We recommend them to you.

We are certain that Senator Bennett’s call for comprehensive reform is not meant as a snub of the encouraging reforms of 2022. Neither is ours. Cutting the property tax rate on manufacturing and ticking down the state personal income tax rate were solid changes that needed to be made.

But as Senator Bennett said:

The underlying problem…is we have got to take a look at South Carolina’s tax policy in a more holistic approach. Since our basic policy was created over 50 years ago, a lot of things have changed.

For our part, Palmetto Promise believes that:

- Too many citizens are paying nothing.

- There are too many (often well-meaning) ad hoc carve-outs, that reduce the tax base.

- The state personal income tax is still too high…and really ought to be flat.

- The corporate income tax needs to go (North Carolina is phasing theirs out).

- The sales tax rate can be reduced if we broaden the base to include more services and not just some goods.

Many of these reforms represent common wisdom that have been included in the findings of the TRAC Commission (2010), the House Republican Caucus Tax Reform Study Committee (2012), Palmetto Promise Institute’s Funding South Carolina’s Future (2015), the Tax Foundation’s Road Map for Tax Reform (2018), and other study committees of the House and Senate.

In line with many of these reforms, Republican Senator Bennett introduces legislation regularly, and on the last day of the legislative session, a tax reform bill was introduced by Democratic Senator Mike Fanning.

What this means is that there could very well be a consensus forming already on a number of the specific reforms that are needed.

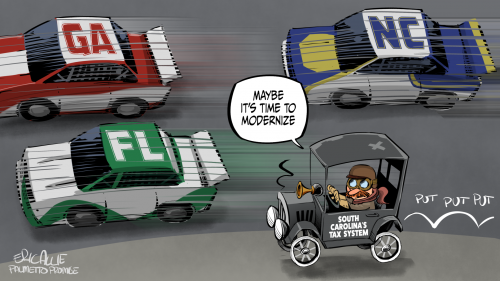

It is commonly known that North Carolina (“#1 state for business,” CNBC, 2023) has taken bold action and we have not. That’s why the Rich States, Poor States Economic Outlook Index ranks South Carolina #21 while North Carolina is #2 and Georgia is #12.

But we are confident that South Carolina is not done yet. Let’s hope 2024 will be the year that we jumpstart reform and begin a process in earnest for what we’ve needed to do for a generation: craft a fair, stable, economically competitive tax code.