North Carolina Cuts Taxes….Again.

South Carolina currently enjoys a dubious distinction: “highest top personal income tax rate in the Southeast.” Our rate is a whopping 7%.

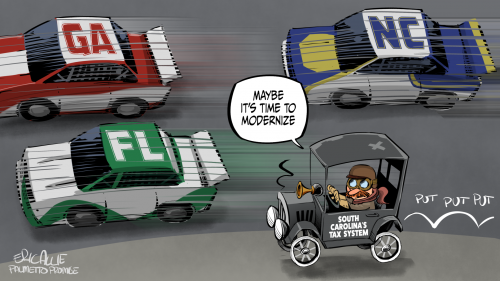

Meanwhile, our neighboring states have been on the move to modernize their tax systems. Georgia recently came off pit row and joined the race to lower their rates. Florida doesn’t tax personal income, and Tennessee has no income tax. The Volunteer State also just voted to phase out their “Hall Tax” on interest and dividend income.

But it is our competitor to the north that keeps lapping us at every restart!

In 2013, North Carolina’s top individual income tax rate was 7.75% and its standard deduction for married couples filing taxes jointly (MFJ) was $6,000. The numbers for 2020 were 5.25% and $21,500. Now the North Carolina legislature has voted to drop their personal income tax rate to 3.99% with a MFJ standard deduction of $25,500 (stepping down fully from current rates by 2026).

But the Tarheel State didn’t stop there. Their corporate income tax, at 6.9% only a short time ago (2013), will be cut each year until it reaches 0% in 2028. (South Carolina’s is 5%, kicking in with the first $1.)

As our neighbors continue to tear up the track, it is critical that Palmetto State lawmakers put their foot on the gas if we are to have any hope of keeping South Carolina competitive and protecting hardworking taxpayers.

UPDATE: The latest report from the South Carolina Bureau of Economic Advisors shows state revenues will continue to rise, and a ruling last week from a federal court opined that state tax cuts would be allowable when federal ARPA funds displace state funds. (This is much to the chagrin of the Biden Administration.)

For years, Palmetto Promise has outlined the urgency of creating a tax system that is stable, competitive, and fair. The stars are aligning to make that happen if we can find the pedal on the right.

Read more here:

A Tax Day Reminder: Cut South Carolina’s Income Tax