What are the options for cutting electricity prices in South Carolina?

In the report released earlier this month by Palmetto Promise Institute entitled Spectrum of Reform, PPI painted a picture of just how high our power bills and our prices are in South Carolina. We also offered a range of possible reforms that could help cut those prices.

In an earlier post summarizing that study, we presented the evidence for high prices. In this part two, we show the full Spectrum of Reform: the range of options for achieving savings for beleaguered ratepayers.

What are the reform options for cutting wholesale and retail energy prices in South Carolina?

CHOICES FOR SOUTH CAROLINA ALONG THE SPECTRUM OF REFORM

- Monopoly Muscle (current South Carolina). The tired old vertically-integrated monopoly model—where a utility is assigned a territory and is guaranteed a profit based on its assets—dominates the Southeastern region of the United States.

- SEEM Scheme. Efforts by large Investor-Owned and Public Power utilities in the Southeast to create a semblance of wholesale competition, but under their control, is a half-measure. Utility ratepayers in all three classes deserve better.

- Wholesale Market Reforms (Intermediate Steps Toward Wholesale Choice). Waystations that could eventually lead to true wholesale competitive real-time purchasing and pooling of assets, like Energy Imbalance Markets and Joint Dispatch Agreements are worth exploring.

- Regional Transmission Organization (RTO). RTOs and ISOs (Independent System Operators) are not monolithic in nature. A home for South Carolina in a wholesale market could take many forms. PJM and MISO run differently. A South Carolina-only “Palmetto RTO” should be in play as well.

- Retail Market Reforms (Intermediate Steps Toward Retail Choice). Retail choice as it currently exists in the United States is nearly impossible to achieve without wholesale choice. But options at the distribution level, or options for large customers only are working in other states like Georgia and Virginia.

- California. California is technically a choice state, and it has its own functioning ISO. But as retail choice exists in California, there is too much government involvement, which reduces risk but inhibits market forces from operating fully.

- Retail Choice. Most of the Retail Choice states—running in a geographic pattern roughly diagonally northeast from Illinois to Maine—have wholesale choice through an RTO but also have retail choice. Generation is divested from the retail side so that residential, commercial, and industrial customers have options that are not tied to generation costs.

- Duopoly. Time may have passed the duopoly market by. This market is one in which two utilities compete in the territorial footprint. But some competition is better than none.

- Willing Buyer, Willing Seller (PPI). A more robust form of competition than duopoly is where two or more vertically-integrated utilities compete with one another. This model was articulated for South Carolina in 2018 by Palmetto Promise. Taking Greer, SC as an example, Duke Energy Carolinas, Blue Ridge Electric Cooperative and the Greer Commission of Public Works would be allowed to compete for customers.

- Texas/ERCOT. Texas is known as an “energy only” market. That means that prices are not based on set rate of return but vary by market forces. An energy-only market pays only for energy that is produced. Texas prices are hard to beat.

- Full Electricity Choice (“Total Freedom”). In this electricity market of the future, there are numerous buyers, sellers, generators, storers, transmitters, distributors, and aggregators all along the traditional system from generation to distribution.

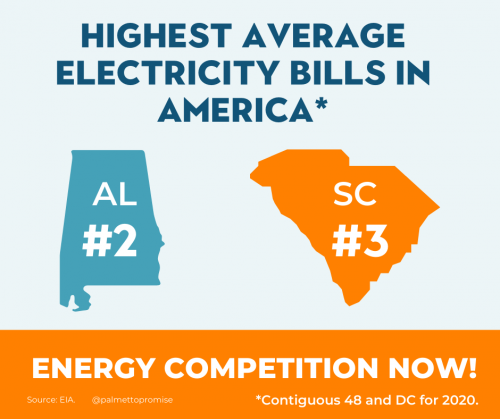

Note: in 2016, South Carolina made it to the top for the highest average electricity bills in America. For the most recent year available (2020), the Palmetto State nearly did it again. Among the contiguous 48 states and DC, we came in at #3.