Pension Forecast: Still Stormy

Ellen Weaver

Governor Henry McMaster recently made headlines, calling for big reforms to South Carolina’s pension plan for state workers. The Charleston Post & Courier reported:

Gov. Henry McMaster wants to increase the age at which government employees can pull money from the state pension plan and ban unfunded benefit increases that would allow state retirement benefits to keep up with inflation.

McMaster, a Republican, also wants all new state employees to be transitioned into a 401(k)-type program, instead of the existing pension funds, and for county governments and local school districts to be placed in charge of their own retirement plans.

“We must now take on the task of making the tough decisions,” McMaster wrote.

Like many states, South Carolina faces massive unfunded pension liabilities. The Palmetto State’s pension woes stem from a toxic brew of poor oversight, an increasing number of state employers, risky investment strategies, exorbitant bonuses and fees paid to fund managers, unrealistic projections of returns and the Great Recession of 2008. Depending on the assumed rated of return, South Carolina’s pension shortfall ranges anywhere from approximately $24B (projecting a 7.25% rate of return) to $75B (calculated by the American Legislative Exchange Council, using a 2.3% rate of return).

Earlier this year, state lawmakers passed a pension bailout that – while correcting some technical problems like the fund’s amortization schedule – put tax payers on the hook for an additional $826M annually by 2023. Under the new law, state workers are projected to contribute and additional $40M a year over the same time frame.

Although this bill was positioned as a down payment on necessary future reforms, like the ones outlines by Governor McMaster, reformers fear that trying to “two step” toward change has given away the leverage needed to make the difficult choices still ahead.

If past is prologue, that’s a valid concern.

Predictably, Carlton Washington, the president of the South Carolina State Employees Association, which represents over 32,000 state workers, is asking legislators to “stay the course” with the current pension system, calling a national shift away from traditional pensions “risky and unproven policies.”

Others might call it facing reality.

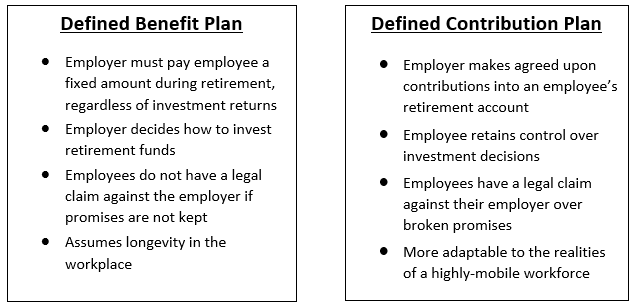

Old-fashioned “defined benefit” pensions simply aren’t sustainable for the long-term…unless you have money trees growing on the Statehouse grounds. Transitioning to a defined contribution retirement plan for new state employees would be wise public policy for South Carolina taxpayers and would help us keep our promises to past, present and future state employees.

Meanwhile, “Hurricane Gray” is swirling rapidly towards South Carolina. Currently, 59 out of every 100 people in our state are 18 or under or under 65 and consuming education or health care and retirement benefits. By 2030, the U.S. Census Bureau predicts that number will be 79 out of every 100, leaving only 21 people paying the bills.

If you aren’t a state employee with a pension, you may be tempted to dismiss this as a problem far from home. But do you drive on South Carolina roads or send your children to a public school in the state? Do you value your courts and state troopers? Have you benefitted from an education at a public college? If left unaddressed, South Carolina’s pension crisis will inevitably squeeze out spending on other services.

With a shrinking percentage of taxpayers shouldering the bill for government promises, we don’t have the luxury of time: South Carolina needs to bite the bullet on big reforms like transitioning to defined contribution plans now.