Public Pension Peril

Adam Crain

When it comes to funding its public pension program, South Carolina is short $74,095,092,870 according to a new American Legislative Exchange Council (ALEC) report titled, Unaccountable and Unaffordable 2016.

That is a staggering number, and if you aren’t a state employee, you may be tempted to dismiss this as a problem far from home.

But are you a taxpayer? Do you drive on SC’s roads or send your children to a public school in the state? Do you value your courts and state troopers? Have you benefitted from a college education at a public college in this state or another? If so, South Carolina’s pension crisis directly impacts you.

According to the report, to fully fund its public pension system today, South Carolina would need $15,133 per Palmetto State resident. That puts South Carolina 25th out of the 50 states for the highest unfunded liability per capita.

But what does all of this mean and how did the Palmetto State get here? The state mandates that its public employees – from Statehouse workers and National Guardsmen, to university professors and servicemen – participate in one of 6 pension plans.

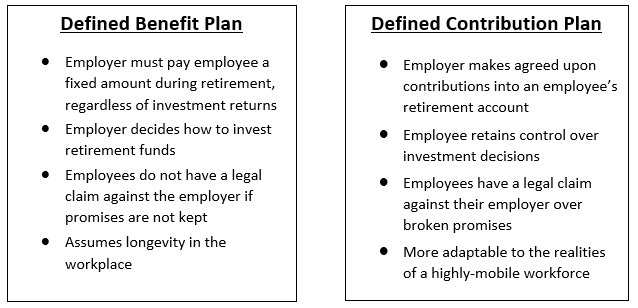

If they choose one of the five plans that are considered “defined-benefit,” the state is locked into paying the employee an agreed benefit at the time of retirement. In other words, the state is obligated by law to pay public servants what they are owed under the terms of the plan the state offered to them.

Unfortunately, a myriad of factors – from over-estimated returns on investments, to the structure of defined-benefit plans, to the Great Recession – have caused widened the gap between the amount of assets the Palmetto State has to cover the costs of these public pensions and the amount our state will be obligated to pay.

ALEC reports that taken together, the fifty states have underfunded public pension plans by $5.6 trillion and outlines both the consequences and the cure:

“The only way to solve this growing problem is for states to enact meaningful pension reform. While some might feel that America’s public pension crisis only threatens current workers and retirees, it is in fact a problem that affects everyone. Taxpayers are on the hook for the legal obligation to cover the promised benefits of traditional, defined-benefit pension plans. Additionally, every dollar that is spent filling the gap in public pensions is a dollar taken away from the core government services. This forces legislators to make a difficult decision of leaving their citizens with fewer services or enacting economically damaging tax increases?

Thankfully, there are solutions to the pension crisis. Promising to meet current obligations for employees already in the system but changing from a defined-benefit to a defined-contribution plan for future public servants has shown signs of success in other states and might be the first place to look for a solution to this growing problem.

Check back with us as the fight heats up for more information on this critical issue. Because South Carolinians should not have to choose between meeting obligations to public sector employees and maintaining core government service capabilities.

What’s Are the Key Differences between Defined-Benefit and Defined Contribution Plans?

How much is SC’s unfunded pension liability? Depends on who you ask:

- ALEC estimates that South Carolina’s unfunded liability is $75 Billion

- Truth in Accounting estimates that South Carolina is concealing $1.5 billion of pension debt.

- The State of South Carolina in a December 2015 Legislative Audit Council Report, reports an unfunded liability of $11 Billion.

- In an August 2016 article, “SC Pension Fund Deficit increased by $1.4 billion,” South Carolina’s Retirement System is reported to have an $18.2 billion unfunded liability.

Why so many conflicting reports?

At this moment, there is only one thing you can be sure of when it comes to the pension system reform debate: no one is sure of how high South Carolina’s unfunded pension liability actually is. One factor in this uncertainty: the expected rate of return used to calculate how much South Carolina’s investment will generate in the future.

Different assumptions about the rate of return and a whole host of other variables creates a wide-ranging estimate of the Palmetto State’s actual unfunded liability. While ALEC used a very safe assumed rate of return of 2.344%, the State of South Carolina assumes – what we would argue is an unrealistic – 7.5% rate of return.

Which underlines a key point: we all know reform is needed. But South Carolina needs an independent actuarial study of our retirement system to understand where we actually are on the map before we can plot our journey for where we need to go.

** SOURCE: Williams, Bob, Jonathan Williams, Theodore Lafferty, and Sarah Curry. Unaccountable and Unaffordable 2016. Arlington: American Legislative Exchange Council, 2016. Print.**