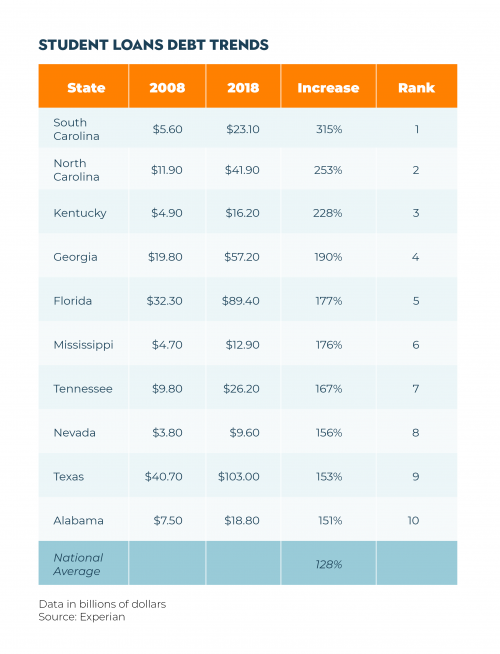

The Palmetto State is #1 in student debt growth. What can be done?

A December 2018 report by the credit monitoring service Experian revealed that student loan debt had reached an all-time high across the nation, with South Carolina the worst offender by far. The average national increase in student loan debt was 127.86%, while South Carolina came in at a whopping 315%, the most of any state. The Experian report provides an opportunity to re-evaluate where we find ourselves as a state in terms of the expense of higher education.

As high school students face the intimidating and stress-inducing decision of where (and if) to attend college, many students are turning to online universities or trade schools. This is in large part due to the cost of a four-year degree. In South Carolina, for example:

- The Institute of College Access and Success reported that South Carolina’s class of 2017 had an average debt of $30,890.

- TICAS also highlighted that 58% of those students graduated with debt.

- In South Carolina four-year schools, we’ve seen an 18 percent increase in the average cost of a four-year degree over the past 7 years.

The costs of higher education across the country, and in South Carolina specifically, is not sustainable and is leaving many students behind.

My Story:

I faced the college decision about 5 years ago, and unable to afford a traditional college experience, I decided to pursue an online degree. While still a junior in high school, I began to rack up college credits through programs such as College Board’s CLEP and Prometric’s DSST exams. I utilized Lumerit Education, an educational technology company that provides resources and designs degree plans for prospective students. They helped me map out my degree so that I could get credits in the most cost-effective and efficient way possible. I spent four years, working through courses and exams from either my bedroom or a coffee shop, and obtained a bachelor’s degree through Thomas Edison State University, an online university. I spent less than $20,000 on my degree and graduated with no debt.

I tell my story in order to highlight one example of a cost-effective higher education option, but I understand that distance learning is not for everyone, and it is there that the travesty of our current situation becomes apparent. There is undeniable value in receiving an in-person learning experience on a college campus. Many students learn best in such an environment, but cost-effective and quality on-campus options are lacking.

I was interviewed by Lucas Daprille of The State about my online college experience, in which I explained that a bachelors degree is almost the bare minimum from an employer’s perspective. The thought of racking up thousands of dollars in debt for a four-year degree, and then having to afford a graduate program is nauseating. Instead of setting students up for financial success, college is often equal to a debt sentence, financially burdening students on the cusp of entering the workforce.

This issue of employment has led students to seek out trade schools for technical and mechanical related jobs. These programs give students hands-on training and often can be finished within 1 to 2 years. Additionally, most trade school programs cost about the same as one year of a bachelor’s degree. Of course, not all jobs have trade schools to prepare you, but it is one alternative to the traditional degree.

Current SC Reform Initiatives:

In response to the rising cost of tuition at South Carolina state-sponsored universities, a group of legislators have introduced the Higher Education Opportunity Act. This bill, which just passed through the Senate Finance Committee on a 17-4 vote, would designate a portion of state revenue from new taxes on retail sales to higher education. It would also freeze the in-state tuition rate, expand merit-based and need-based scholarships, and provide funds for campus infrastructure repairs. Palmetto Promise has not analyzed the impact of this legislation, but we will monitor its progress for the impact on the taxpayer. You can read more about it here.

One method of grappling with the rising costs of higher education is to understand how colleges spend their funds, whether it’s tuition and fees, state appropriations, or alumni and other giving which make up the bulk of their budgets. Our friends at ACTA (the American Council for Trustees and Alumni) have just rolled out a resource with that very title, “How Colleges Spend Money.” Their site, along with this article may help shed some light on this issue.

While student loan debt continues to sky-rocket, it’s important to highlight other options for students, but I think it’s paramount to keep in mind that the existing system is not working. Our higher education system should be working for students, empowering them and giving them tools for success. Rather, we sit at 44 million borrowers in the US who owe $1.5 trillion dollars in student loans as costs continue to surge upward. It’s vital that we not only hold higher education providers accountable for rising costs, but also that we re-examine the direction of higher education and pursue cost-effective, common-sense alternatives.