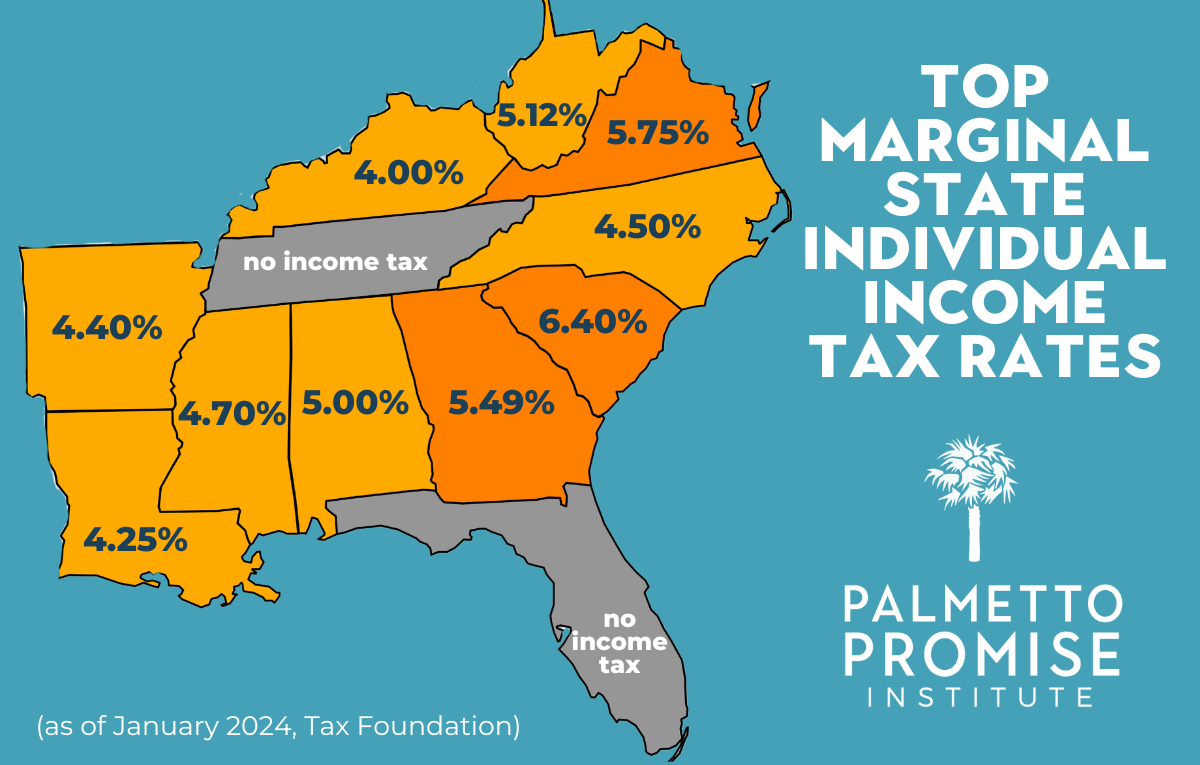

What Tax to Cut? Property or Income?

At Palmetto Promise, we are always reluctant to question any move by the South Carolina General Assembly to cut taxes or flatten tax rates. So, we greet with joy the fact that in the wake of an estimated $500-$600 million state revenue surplus that has built up since 2020, the Senate and the House are