Dilemma: Mortgage Payments or Health Insurance?

Elisabeth Kines

KEY TAKEAWAYS

— An insurance card does not equal access to affordable health care

— New options in South Carolina are creating opportunities for patient control

For a healthy adult, my medical history has run the gamut.

I’ve been hospitalized in the U.S. and in the U.K. I’ve had employer-sponsored insurance coverage and been uninsured. I’ve had an HMO, a PPO and an EPO. I’ve bought insurance through Obamacare. And on and on it goes.

My bumpy medical history arose from two unexpected catastrophes, precisely the kind of worst-case scenarios insurance brochures warn you about. The first health crisis occurred while I was living abroad, hence the U.K. hospitalization, and the second occurred here in the States.

That second hospitalization taught me a sobering truth: health insurance is not synonymous with health care.

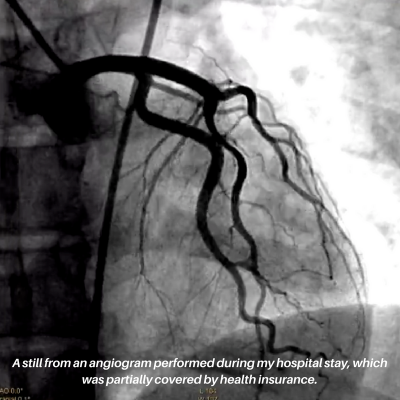

When I checked into the ER with severe chest pains on a warm January night, I had an insurance card linked to really fantastic coverage in my wallet. Of course, you aren’t thinking about co-pays when the doctors tell you your heart is beating like an unrehearsed punk rock band—a sign you may be having a heart attack. And you aren’t thinking to ask if the nurses are using generic options of morphine as they prep you for an emergency operation.

No, you are only thinking about how grateful you are for the kindness of strangers, offering care during your darkest hour.

After I was released from my two-day hospital stay and had begun the many rounds of follow-up visits, I learned that insurance coverage I believed to be fantastic was actually completely useless to me.

Because of a contract dispute, the hospital caring for me was declared out-of-network by my health insurance provider on day two of my three-day hospital stay. This meant all costs associated with my care after that first day were my full financial responsibility.

There was no notice, no letter in the mail. Just me in a hospital bed with a useless health insurance card.

Since that experience, I’ve become an avid reader of the fine print on health insurance plans.

When an announcement was made in South Carolina last year that health insurance premiums would rise, I expected a minor bump in costs. Instead I found a massive hike not only to my monthly premium but also to my deductible—combined costs that equaled my yearly mortgage payments. I’d also be expected to pay the bulk of any hospital stays—something that could surely bankrupt me.

I made the difficult decision to walk away from traditional health insurance, and I have not looked back.

Today I am covered for catastrophic events and primary health needs through two innovative resources available right here in South Carolina: Healthcare Sharing networks and Direct Primary Care.

Healthcare Sharing is a simple concept where individuals and families committed to healthy lifestyles and holding similar beliefs form a co-op of sorts to share one another’s medical expenses. Overseen by non-profit organizations—there are roughly seven in the United States—members share expenses rather than filing claims for coverage with insurance.

This model isn’t for everyone—there are lifestyle requirements, and some associations don’t allow the cost of pre-existing conditions to be shared with fellow members—but for me, it has been exactly the catastrophic coverage I need at a price I can afford.

With Direct Primary Care (DPC), I pay a monthly membership fee to my doctor. For that fee, I have something I never had with any health insurance plan—24/7 direct access to my physician, appointments that aren’t rushed, complete transparency in costs and the shared doctor-patient goal of keeping my prescription and lab costs low.

Where routine blood work cost me $350 under my former health insurance plan, I now pay $40. That savings of $310 is staggering for me. That’s is $310 that can go toward education, paying down debt, home repairs or even my monthly Healthcare Sharing bill.

Aside from the cost savings, my new way of doing health care has given me something I never found through my traditional insurance plans – control. I chose my doctor based on our rapport not on the insistence of an insurance commissioner I’ve never met. And I chose catastrophic coverage based on my needs and lifestyle.

The health care plan I have chosen for myself gives me confidence I’ll never again find myself in a hospital ER with a useless health insurance card.

My hope is to see opportunities like these protected and expanded in South Carolina, so people have access to truly affordable health care options especially tailored to meet their needs.