House wants income tax reform to conform

Editor

This originally appeared in the Statehouse Report on March 16, 2018.

By Lindsay Street, Statehouse correspondent

South Carolina could get its first real shot at income tax reform this session or next after more than a decade of talk, said Speaker Pro Tem Tommy Pope, R-York.

That’s thanks to a little-known, annual adjustment called conformity in which the state’s income tax system income aligns to meet the federal standards. If the state and federal systems don’t conform in multiple areas, some say South Carolina taxpayers might have “an accounting nightmare.”

But conforming to the federal standards also could bring an unintended tax increase, unless the state also adjusts its income brackets, officials said. Work has already begun in the House to conform to the new federal taxable income rates, and the clock is ticking toward an income tax increase that would bring a nearly $200 million windfall for state revenue in 2019.

State lawmakers on both sides of the aisle are seeking solutions to stop an inadvertent tax increase. Those efforts have coincided with recommendations released last month by a special House tax study committee. Led by Pope, the committee recommended combining five income tax brackets with rates from 3 percent to 7 percent in favor of a single, flat income tax of 4.85 percent.

In a year’s study of the state’s tax system, however, the committee did not consider the conformity issue, especially since a huge federal tax overhaul wasn’t envisioned. And now, some see conformity as a catalyst to flatten and broaden state income tax. But there’s a catch: If legislators decide to make structural changes to the income tax system and they want to be revenue-neutral to the state budget, reformers may also have to cut some income tax exemptions to generate enough money to offset a change to a single bracket.

Pope has taken to calling it “reformity.”

Why conformity matters

Conforming to the federal taxable income means an easier tax return for taxpayers and their accountants. Once you’re done filling out your federal return, conformity allows one to use federal numbers to begin the annual South Carolina return, instead of having to start all over.

It also makes things easier for the state Department of Revenue, according to Ken Newhouse, chair the governmental affairs committee for the South Carolina Association of Certified Public Accountants. In a previous interview with Statehouse Report, Newhouse called conforming “piggybacking off the fed.”

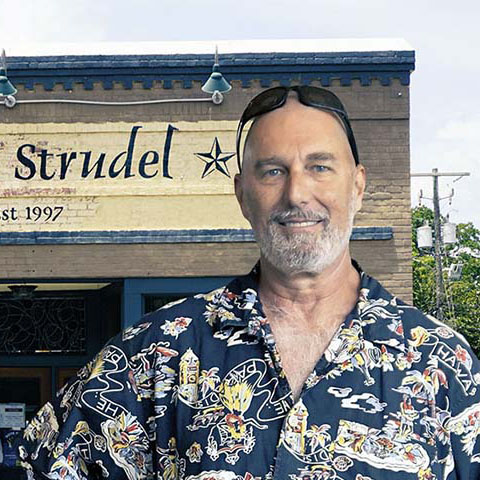

Pope

“It’s got to happen no matter what. We got to do something or it’s going to be an accounting nightmare,” he said.Pope said lawmakers aren’t even considering not passing a conformity bill, which has yet to be filed in either the House or Senate.

As the House catches its breath from passing the budget this week, its Ways and Means Committee is expected to tackle the issue. An exact timeline of when work begins was not available this week, and there are no committee meetings scheduled next week.

‘Reformity’

Tax watchdogs are already raising their hackles. The Palmetto Promise Institute is a conservative-leaning think tank in the state with former U.S. Sen. Jim DeMint on its board. The institute’s president, Ellen E. Weaver, released this statement to Statehouse Report:

“At a bare minimum, state lawmakers should fix this unintended tax increase … In doing so, they can also move our state closer towards the fundamental tax reform our unfair, failing system so desperately needs.”

The special House tax reform committee intends to send a bill to the House Ways and Means Committee by the end of March, Pope said.

“My hope is that would move with conformity,” he said. “We’ve got to deal with conformity anyway, and we’ve got income tax reform ready. Let’s roll them together.”

“There will be some serious discussion to make some changes on the income tax side,” he said.S.C. Rep. Roger Kirby, D-Florence, also served on the tax committee. He said tax conformity and a corresponding adjustment to keep taxes from rising are nonpartisan issues.

However, Kirby said there is talk about allowing the unintended tax increase to happen without tax reform — but he did not provide information on who wanted to see that happen.

“That’s not going to bode well,” Kirby said. “If the public is aware our inaction has created that sort of windfall for the state, that won’t go over too well.”

Pope called the conformity issue a “sleeping giant,” and Kirby said that with the SCANA-Santee Cooper nuclear debacle and other “fires” that the House has dealt with this session, not many House members have the issue on their radar just yet.

“I don’t think a lot of the body fully understands or appreciates what’s going on there because we haven’t had an opportunity to discuss it as a body,” Kirby said.

Pope said, however, there is a chance tax reform could still bog down.

“The only concern I’ve heard is from the accountants is if you get in a battle about the reform bill as we often do … not letting reform pull down conformity. Pure mechanics: conformity has to happen,” he said.