South Carolina’s State Retirement System: A Look Behind the Curtain

In 2015, South Carolina’s Office of the State Treasurer released a report on the health of the state employee retirement system entitled “The Pothole that you can’t see.” In this examination of our state’s pension system, the numbers were shocking. According to the report, as of 2015, the state retirement system’s unfunded liability stood at $18.8 billion.

In the decade since this study was released, South Carolina’s pension system has improved very little. According to Truth in Accounting’s annual report “Financial State of the States 2024,” South Carolina is ranked 36 out of 50 states for overall taxpayer burden (50 being worst). The report finds that as of the end of 2023, South Carolina was at $7,700 in per capita taxpayer burden. This taxpayer burden is calculated by taking the state’s total pension liability and dividing it by the number of taxpayers.

What is a Pension? Unfunded Liability?

In its simplest form, a pension is a plan for employees maintained by the employer that provides future retirement income. The traditional employee pension plan is a defined benefit plan in which a specified monthly benefit is paid upon retirement. The amount is typically determined by the years of service, the salary level of the employee while working, and, often, adjustments for inflation over time.

An unfunded liability in a pension system is the gap that exists between the present value of the promised benefits to retirees and the current assets (money) in the pension fund. This unfunded liability is the problem that currently lurks within our state pension system.

The terms, “pension” and “retirement” are often used interchangeably, but true pension plans were common in the private sector for decades but are now found more typically only offered to government workers such as first responders, government officials, or teachers. A pension typically guarantees a retiree a set payment or benefit, a “defined benefit” for the remainder of his or her life and, perhaps, to the remaining spouse after death. A retirement plan such as a 401(k) or 403(b) is funded by employees and, typically, some matching by the employer in what is called a “defined contribution” plan. These plans accumulate value until the employee retires though the balance and, thus, the amount available in retirement, rises or falls depending on the success of the investments.

The Taxpayer

Concerns over unfunded government pension liability are too easily brushed off, as elected officials can perceive the burden as a non-current issue that can be handled in the future. They perceive the present budget issues and voter concerns to be more important than those of SC taxpayers in the future. Nevertheless, the entirety of the unfunded liability will eventually be paid by SC taxpayers if the pension fund is to pay its promised benefits.

Recent Actions

Act 278 (2012)

Passed in 2012, Act 278 made some minor changes to the SC retirement system with a new “Class Three” tier for employees hired on or after July 1, 2012. Ultimately this established new requirements for full retirement benefits.

Changes included:

- Increased service requirements

- Increased the vesting period (from five to eight years)

- Eliminated the use of unused credit (sick leave, vacation time) in retirement calculations.

Retirement System Funding and Administration Act of 2017

This 2017 Act had a goal of lowering the unfunded liability in the SC retirement system.

Changes included:

- Assumed rate of return was lowered from 7.5% to 7.25%

- SCRS (South Carolina Retirement System) employee contribution rate was increased to 9%

- PORS (Police Officers Retirement System) employee contribution rate was increased to 9.75%

- Employer contribution rates for both SCRS and PORS increased by 2%.

- Funding years were also reduced from 30 years to 20 years beginning in July of 2027.

The Effect on Unfunded Liabilities

There are only four levers available to reduce unfunded liabilities:

- Inflows: Contributions, from either employers or employees can be increased.

- Returns: Higher returns on the invested assets can increase the pension assets.

- Expenses: The costs of investing and administering the plan can be reduced.

- Outflows: The benefits to be paid can be reduced.

These policy changes in 2012 and 2017 were steps in the right direction toward the increasing contributions and reducing benefits (technically, by increasing the requirement to be eligible for benefits). However, these legislative changes have not been sufficient to address the pitfalls of South Carolina’s defined benefit plan.

Recent Trends

In 2024, Pew published research on long-term liabilities that affect finances across all fifty states in an article titled “Long-Term Liabilities Weigh on State Finances”. They examine the problem of unfunded liabilities, especially those related to pension and health care retirement plans, sharing that these debts are often overlooked by state policymakers due to the nature of these debts being paid in future decades. However, this mindset and predisposition to overlook such programs has caused the liability to skyrocket and has put SC into the predicament of struggling to meet financial obligations to SC retirees.

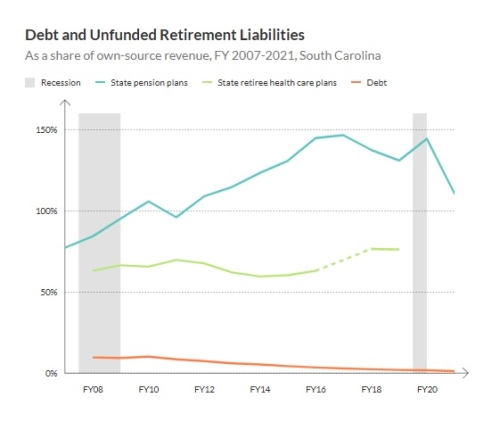

As shown in the chart below, South Carolina’s unfunded pension liabilities (represented by the blue line) increased by 33.1% between 2007 and 2021.

Source: PEW (2021)

Our unfunded liability has experience a secular increase with exception of 2021, what Pew called “once-in-a-generation returns on stock market investments,” That banner year narrowed unfunded liabilities though, nationally, $836 billion in unfunded pension benefits remained in 2021.

How did unfunded liability get this bad? During the Great Financial Crisis of 2007-2009, unfunded liability rates grew immensely. States were not prepared for the lower-than-expected (i.e., negative) investment returns while contribution were not adjusted sufficiently to account for the losses.

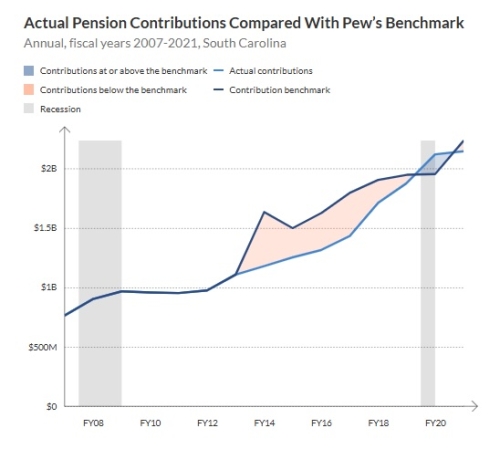

In the chart below, you can see how our state of South Carolina struggled with this as well. The red-shaded area in the chart below represents a significant period of time during which our state did not sufficiently adjust contributions to accommodate changes in investment returns.

Source: Pew (2021)

South Carolina needs to make changes to ensure a sustainable pension system. Quite simply, sustainability can be reached by changes to our pension system that use one or more of the four levers to eliminate the unfunded liability.

Defined Benefit Plan vs. Defined Contribution Plan

Currently, South Carolina uses a pension plan that closely resembles a defined benefit plan. This model sets an amount that will be paid to employees upon retirement. Given the unfunded liability, South Carolinians must bridge the gap between what is owed to these retirees and how much money has been set aside. Eventually, this will affect all SC taxpayers, including those who are not entitled to the pension plan, because the state budget will be reallocated to fund benefits or the state will need to generate new funds to cover the gap.

What’s a solution? A true defined contribution plan for public employees is a potential solution. This type of plan, typically administered by an outside investment firm, collects contributions from an employee’s paycheck. The employee and employer set aside a percentage of pay that is placed into an individual account for the benefit of that individual. There is some discretion as to the percentage an employee saves. This flexibility allows the individual to adjust amounts as needed and as available over time. The more an individual saves, the more accrues in the account. As such, those who save more, get more. Further, the individual is responsible for saving while SC taxpayers are not responsible for their retirement benefits.

With a well-crafted defined contribution plan in place, the threat of taxpayers being potentially “on the hook” for unfunded benefits is removed.

The Benefits of the DCP?

To the Employee

- Contributions made by an employee are made on a pre-tax basis, which lowers the taxable income at the end of the year.

- The employee has more control over when the income is paid out, which could help maximize the benefits of the plan.

- An employee can typically take a DCP account to a new employer’s plan (“rollover”), unlike the defined benefit plan that does not move across jobs outside the public sector.

- The employee is empowered to make investment decisions with the help of professional advisors, offering more flexibility for employees to cater to their own future and tolerance for investment risks.

- Money contributed and earned in investment is the employee’s money, unlike the defined benefit plan, in which funds are available to all pension beneficiaries.

- An employee can, within ranges, contribute more or less to accommodate current cash needs and desires to have more or less in retirement.

To the Employer

- There should be a smaller administrative burden given that many investment firms will compete to administer the program efficiently. The employees are in control of their own plans.

- The employer is no longer responsible for shifts in asset markets that affect pension fund values.

Taxpayers

- Tax dollars are no longer being used to compensate for the growing unfunded liability of our current pension programs. Tax dollars are better allocated toward community resources such as schools, roads, hospitals, and more.

- Taxpayers (most of whom are not pension fund beneficiaries) are not required to fund the liabilities of a pension fund that has become so underfunded.

…the South Carolina Retirement System, often called the “state pension plan,” has one of the largest unfunded liabilities in the nation, at nearly $24 billion. The system only has assets equal to 64 percent of what is required to pay beneficiaries, which places our pension system fifth worst in the nation.

…I ask that the state plan be closed to new beneficiaries as of December 31, 2023, and that new state employees prospectively enrolled in the State Optional Retirement Program, which is a defined contribution 401(k) plan. Another year of inaction is another year in which the unfunded liability in the pension plan will increase. We cannot “kick this can down the road” any further.

-Governor Henry McMaster in his 2023 State of the State Address

Our Hopes

It is time that something is finally done about our pension problem here in South Carolina. The SC pension plan as currently configured is not sustainable. South Carolina needs to make drastic changes to the current system or close it to new beneficiaries and direct new employees into a defined contribution plan.

To read more about the reforms needed in our state employee retirement system, check out some of our prior articles; Pension Forecast: Still Stormy and Public Pension Peril.