South Carolina residents hardly need an introduction to one of the most significant sources of tax revenue in the Palmetto State: property taxes. The property tax is one of the Palmetto State’s oldest forms of taxation and is a staple for state and local government revenue all across the country.

According to the Tax Foundation, property taxes are defined as both immovable properties, such as buildings or land, and moveable or tangible personal property, such as vehicles or equipment. Property taxes are the largest source of both state and local government revenue in the country, funding a community’s most used services such as schools, roads, and even police and fire services. In South Carolina, the property tax (28.6%) edges out both the individual income tax (25.9%) and the sales tax (23.9%) in percentage of state and local tax collections.

South Carolina residential property taxes are fairly low when compared to other states. Owner-occupied homes’ effective tax rate as a percentage of the home’s value is 0.47%, according to the Tax Foundation, which ranks the Palmetto State #47 when comparing property tax rates by state. That’s good for the 4th lowest effective residential property tax rate in the nation for owner-occupied homes.

But South Carolina still has its property tax problems, particularly when it comes to commercial property, which we wrote about a few weeks ago, and in residential property that is not the owner’s primary residence (e.g., second homes and rentals). This means that South Carolina landlords (and therefore renters who rent from them) bear an outsized property tax burden. And in a state that is currently ranked #1 in the nation for population growth, these property tax costs passed directly to renters can create shortages of accessible, affordable housing.

It does not have to be this way.

In South Carolina, property taxes are applied against fair market value or assessment ratios. Established in 1975, fair market value created the basis of property tax assessment, classifying real property with assigned assessment ratios for each property.

To calculate the property tax rate, the South Carolina Chamber of Commerce’s South Carolina Property Tax study has simplified this process into easy steps:

- An assessment is conducted of the property to determine its appraised value, typically by the County Assessor’s office.

- The value is then multiplied by the assessment ratio stated in the South Carolina Constitution (4% owner, 6% rental, for example) to determine the assessed value.

- The millage rate set by the local government is multiplied by the assessed value.

The following table shows the assessment ratios for the various types of property in our state:

The Tax Foundation, in combination with the South Carolina Chamber of Commerce, has highlighted the commercial and renter property tax burden in a recent study. Homeowners, especially long-term, receive enviable low tax rates compared to their renter and commercial property owner counterparts, who face the highest tax burdens. Shockingly, a residential renter or small business owner can pay up to 3 times more property tax than a homeowner.

The owner-landlord wrinkle in the South Carolina tax system is due to the passage of Act 388 (2006). That legislation was extremely significant as it raised the sales tax by 1% in return for removing school operating costs from owner-occupied homes. This swap shifted taxes away from homeowners to other property taxpayers—all without amending the State Constitution. In terms of schools, owner-occupied homeowners now pay only for bonds that are used to fund major capital projects. (Selling these bonds must be approved by voters. Sometimes the school bond referenda are successful, sometimes they are not, as our 2024 analysis shows.)

The Lincoln Institute of Land Policy states how the differences between taxation of rental properties to primary residential property are inequitable.

First, homeowners typically have higher income than renters. Thus, the differentially heavy taxation of renters fails the ability-to-pay principle. Second, homeowners are the primary beneficiaries of school spending. Thus, exempting primary residences from paying for school operating costs [as a result of the passage of Act 388 in 2006] fails the benefit principle.

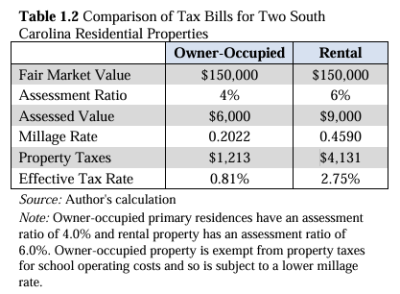

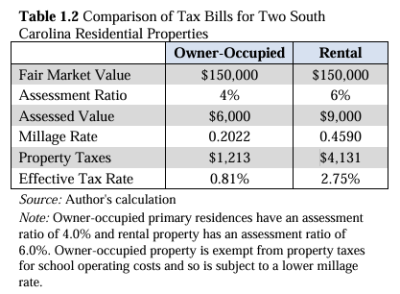

To put this into perspective, the chart below from the Lincoln Institute study compares two identical market value properties in identical taxing jurisdictions, side-by-side, to illustrate the different tax rates and bills. Clearly, the tax on rental property, $4,131, is approximately three-and-a-half times higher than the owner-occupied property, $1,213. Note that the rental property is subject to a higher assessment ratio but also to a higher millage rate because the rental property does not enjoy the exemption for school operating cost millage that the owner-occupied property does.

While landlords are presented with the rental property tax bill, it is South Carolinian renters who will in fact pay the most expensive of property taxes. Creating an unwanted bias against renting, in an already increasing housing shortage and an ever-rapid rate of population growth, creates a perpetual cycle of increasing taxation. In other words, because taxes are higher for rental properties, tenants will pay more in rent, worsening living standards, and reducing the number of housing units that are affordable (The Lincoln Institute of Land Policy).

Second homes, that is, any additional property besides the primary residence (or the “homestead”), both in and out of state, are taxed at a high rate in the Palmetto State. Referencing the assessment ratio for property, most personal, corporate, agricultural, commercial, and rental properties, including second homes, face a 6 percent assessment ratio rather than the 4% homestead ratio. The taxation of second homes in South Carolina leaves our state at a disadvantage for buyers looking to purchase a beachfront or mountain property, for example. The assessment ratio may create an image of a greater opportunity for buyers to buy property on the coasts of North Carolina or Georgia rather than South Carolina, whether this is borne out in the effective tax rate or not. North Carolina uses the same property tax assessment ratio for second homes and rental property as for homesteads. Georgia, like South Carolina, has a homestead exemption that applies only to a primary, permanent legal residence, and they do not tax second homes at a higher rate.

At Palmetto Promise Institute, we have advocated for tax reform that is truly comprehensive for over ten years. For over a decade, we have been calling for addressing every part of the tax puzzle: property, sales, and income. When it comes to the property tax, we cannot leave renters out of the conversation. That’s why the next round of tax reform should include broad-based property tax reform. Increasing housing shortages and an ever-rapid rate of population growth demand it.