Victory for Taxpayers – Individual Income Tax Rate Cut Again!

Since 2017, Palmetto Promise Institute has been sounding the alarm that our South Carolina tax code is unfair, uncompetitive and imbalanced. In 2019, we took our claims to the next level by commissioning and releasing an econometric tax study by the foremost independent economist in South Carolina, Dr. Rebecca Gunnlaugsson.

Turns out we were right!

Her findings were clear: all three of our major taxes (four, if business taxes were included in the mix) were in need of major reform. The individual income tax rate, the property tax rate, and the sales tax rate were too high and unfairly chose winners and losers. Business property taxes were hurting our economic development efforts.

Finally, in 2021, we began to detect legislative interest in focusing on fixing one of these taxes: the individual income tax. Like in a football game, our offense took what the defense gave us. The individual income tax became our target.

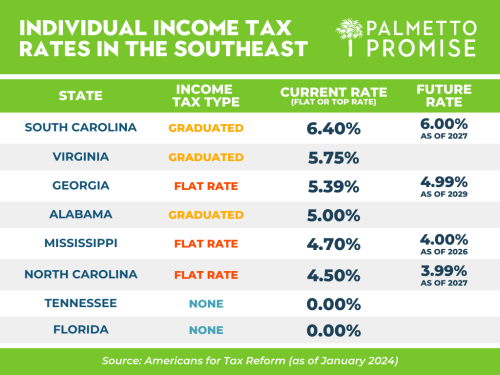

The legislative plan shook out like this: cut our highest in the Southeast 7% tax to 6%. The initial reduction was from 7% to 6.5% (2022). Each year after that, the trimming was to be .1%. But as the graphic below shows, we had a long way to go to even get in the ballpark with our neighbors.

The individual income tax was to be permanently reduced from 6.4% to 6.3% this year. But, we suggested that the trimming be sped up. Governor McMaster called for this in his State of the State Address.

We are glad to announce that the Conference Committee on the state budget agreed last week to indeed accelerate the income tax cut. The new rate will be 6.2%. Yes, 6% would have been preferable, or even 5%, but this is progress. Note: In the 2022 reform, the individual income tax brackets were collapsed, the industrial property tax rate was cut, and annual indexing to inflation was continued to prevent bracket creep (aka higher tax bills simply due to inflation).

Thanks to these cuts, state taxpayers will have kept $1 billion more of their hard-earned income.

But is that good enough?

If not, what do we want long-term? Take a look at that graphic again. How about a 5% flat tax rate?

A lower and even flatter rate would stimulate our economic development engine even more. That kind of rate would signal to employers considering coming to South Carolina that their employees would be able to keep more of their income and enjoy greater prosperity.