What Is South Carolina Hiding?

Ellen Weaver

In our recently published article titled South Carolina’s Manufacturing Revolution, we wrote that while South Carolina’s current economic performance ranks us at a relatively strong #20, our long-term outlook has fallen to #32, largely based on debt levels and an uncompetitive tax structure. (Source: 2015 Rich States, Poor States Economic Competitiveness Index).

Today, we take a look at the stark truth about our state’s current debt situation.

According to Truth in Accounting, a non-profit group of CPA’s, because our state government uses outdated accounting methods*, $16 billion of retirement debt is not recorded on South Carolina’s balance sheet (in other words, is owed but not funded). You heard that right: $16 BILLION.

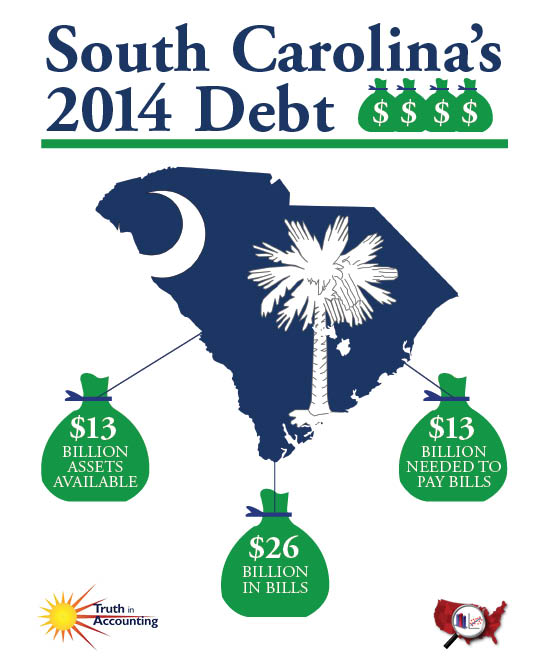

When factoring this figure in to the total $26 billion of debt that South Carolina owes and backing out the $13 billion in assets that are currently available to cover that debt, our state falls $13 billion short in what we need to pay our bills. Divided among every state taxpayer, that comes out to $9,700 a person!

[popuppress id=”3155″]

Where did this debt come from? 62% of it is unfunded pension and healthcare benefits for state employees, essentially a credit card balance of unpaid retirement contributions from prior years. As the folks at Truth in Accounting aptly say, “Unless these pension and retirees’ healthcare benefits are renegotiated, future taxpayers will be burdened with paying for these benefits without receiving any corresponding government services or benefits.”

Furthermore, how can South Carolina policymakers possibly consider taking on more debt, or expanding ballooning programs like Medicaid, with no clear plan to address this massive structural debt that is already on the books? Making good policy decisions requires taking an honest look at our financial picture. And if we don’t look at long-term solutions to deal with our debt problem and uncompetitive tax code, that picture doesn’t look rosy.

*For fiscal year 2015 financial reports, the Government Accounting Standards Board, which sets accounting rules for state and local governments, will require governments to report their unfunded pension liability on the face of their balance sheets. However, the unfunded retirees’ health care liability will remain hidden off the governments’ balance sheets.