Commentary: One cheer for the outcome in the Jessica Cook case

This Op-Ed, written by PPI Senior Fellow Oran Smith, PhD, was originally published in The Post & Courier. The graphic was created by PPI and not included in the Post & Courier’s publication.

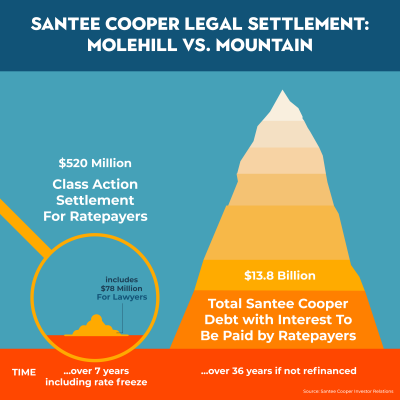

In the case of Jessica Cook et al., a South Carolina court approved a settlement between state-owned Santee Cooper, the former SCE&G (now Dominion Energy) and representatives of Santee Cooper ratepayer classes. That $520 million deal will yield $442 million to 1.6 million unique class members and $78 million to nine law firms.

As the court was both mediator and tribunal, there were interactive congratulations all around. “No one thought a settlement could be reached, but ….” “In all my years of practicing law in South Carolina ….” The lawyer-to-lawyer accolades echoed those that followed a resolution of the SCE&G ratepayer claims in the Lightsey case.

We take nothing away from the attorneys for the class who fought hard for the ratepayers. Santee Cooper and SCANA/Dominion attorneys in the case zigged and zagged like the Crazy Ivan maneuver in “The Hunt for Red October.” And 2.5 million pages of documents later, the plaintiff attorneys persevered and got their clients $442 million.

So what does the $442 million represent? And how does that figure fit into the overall picture of what Santee Cooper ratepayers bear?

The $442 million figure is the advance finance cost paid by Santee Cooper customers until abandonment of V.C. Summer units 2 and 3. Had the settlement covered the cost paid until the date for the Jessica Cook et al. class-action trial (around Feb. 20, 2020) the figure would have been $730 million.

But the original Jessica Cook complaint filed with the court in Hampton County contained this sentence: “To date, Santee Cooper customers have financed debt totaling $4.7 billion in pre-construction, capital, in-service, construction, interest, and other pre-operational costs associated with the Project.” There is an even larger figure. When all debt and interest for the utility are calculated — which is the amount Santee Cooper ratepayers will be on the hook for minus any refinancing — the number stands today at $13.8 billion.

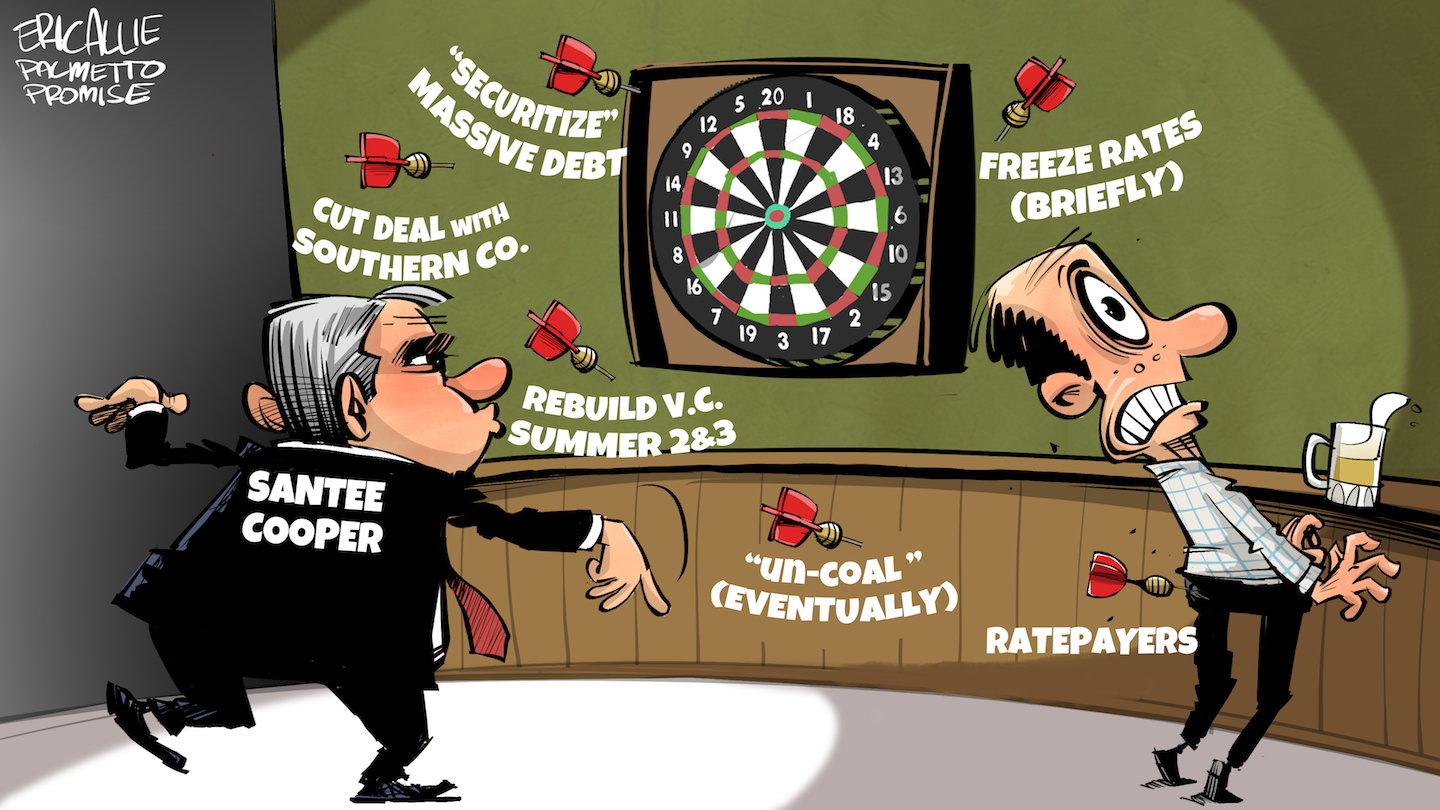

In response to the Jessica Cook settlement, some have proclaimed that such a win in court, which also includes a four-year “rate freeze” based on a “reform plan,” could end efforts to sell Santee Cooper.

That assertion does not compute for a number of reasons: The Cook settlement has wiggle room for Santee Cooper; the customer rebates paid by Santee Cooper must come from somewhere; the long-term reform plan of Santee Cooper has high hurdles to clear to be feasible in the post-Atlantic Coast Pipeline world; and $442 million doesn’t touch the $13.8 billion Santee Cooper ratepayers and their grandchildren (great-grandchildren?) will actually have to pay for V.C. Summer, other defunct Santee Cooper projects and other debt.

With Jessica Cook in the rearview mirror, and COVID-19 still raging, it is time for the state to drive a hard cash bargain with a buyer that will maximize benefit to both ratepayers and taxpayers by removing not only all debt, but all doubt about the superiority of the sell option.