Potential last-ditch efforts by Santee Cooper ahead of report release

Before the bell rang on the 2019 legislative session, lawmakers passed a bill that set the stage for a potential sale of Santee Cooper in 2020. The bill stipulated that the Department of Administration would receive proposals to (1) sell the state-owned utility, (2) management offers, and (3) a proposal from Santee Cooper to reform themselves.

The Department of Administration (DOA) report was due on January 16, 2020, but DOA requested a 60-day extension that was granted. DOA Director Marcia Adams has said that they do not expect to use the full 60 days, so we expect to receive this much anticipated report very soon.

In anticipation of this report and the potential reform proposals from Santee Cooper, Palmetto Promise Institute released a comprehensive paper that takes a look at the potential maneuvers Santee Cooper could try to convince the legislature not to sell the state-owned utility: After the V.C. Summer Iceberg: Which Lifeboat is safe for Santee Cooper Ratepayers?

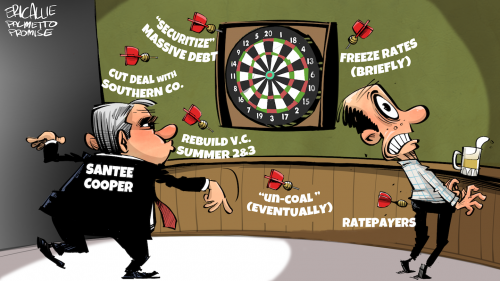

While we await the Department’s recommendations, let’s take a look into our crystal ball at the reform package Santee Cooper could present to the Department and General Assembly as a last ditch effort.

- First, Santee Cooper announced in September 2019 after hiring new CEO Mark Bonsall that they would institute a brief 5-year rate freeze, in addition to the 2-year freeze that ended in 2019. Although Santee Cooper lauded it as beneficial to ratepayers, what it amounts to is kicking the can down the road. Given the long timeline for paying off V.C. Summer and other obligations (until 2056), this is doable in the short-term, but does little to reduce the massive debt burden that co-op and direct-serve customers will face in the long-term.

- Santee Cooper has also discussed “securitizing” their debt load, which is a form of refinancing that involves the converting of financial assets from one form of financing to a supposedly lower-cost, higher-leveraged form of financing. The issue is that Santee Cooper is already as “securitized” as it can possibly get. Santee Cooper has already used low-cost, primarily tax-exempt debt to finance their adventures in nuclear project development and other initiatives. If you refinance low-cost, tax-exempt debt with…low-cost, tax-exempt debt—which is what you would do in a securitization—how do you create lower costs by simply substituting one bond for another of equal cost?

The concept of paying off old debt on Santee Cooper’s balance sheet and replacing it with new debt does nothing to change the leverage variable (cost of borrowing), which is the main benefit provided by securitization.

- Part of Santee Cooper 5-part plan includes the promise “leaner, greener” future in which they are less dependent on coal for energy production. But this will be a heavy lift. Data from the South Carolina Energy Office showed that Santee Cooper actually increased its dependence on coal over the last two years. Closing coal-powered plants and reducing dependence on coal would bring Santee Cooper in line with the operations of investor-owned utilities, but the V.C. Summer debt load will allow for little in the way of cash for capital expenditures.

- In August 2019, right after the South Carolina legislature passed a bill that would seek bids form potential Santee Cooper purchasers, news broke that Santee Cooper was talking with a Korean company to rebuild the nuclear reactors at the center of one of the greatest financial failures in the history of South Carolina. Of course, this was never a serious option and just served to distract from the conversations surrounding a sale of the utility. Such a gambit also fails to recognize the many hurdles: obtaining a FERC license (the old one was surrendered in January), finding financing (Vogtle just hit $27 billion), finding buyers for the power, securing clear title to the materials at the site which is in litigation, obtaining rights to the AP1000 technology under a Westinghouse/Toshiba patent, and avoiding the issue of foreign ownership.

- Lastly, after H.4287 passed the General Assembly, Santee Cooper reached an agreement with The Southern Company. This M.O.U. isn’t illegal per se, but was considered an improper and imprudent attempt to bypass the legislature’s intent. Its real value was also questionable. The Department of Administration and the Chairman of the Senate Finance Committee warned Santee Cooper that their attempts to enact Memoranda of Understanding with other utilities would constitute activity that would run afoul of H.4287, the Santee Cooper joint resolution.

Three options for the future of Santee Cooper will be on the table for the legislature to consider: new outside management, self-managed reforms, and sale to another entity. With the former two options, these maneuvers are Hail Marys to delay debt or simply kick the can down the road—and both run the risk of a financial explosion. But with a sale, paying off (and writing down) the asset and removing it from the rate base entirely would be required of any buyer, making stop-gap water-treading options (illustrated by the darts in the adjacent cartoon) moot. Last ditch maneuvers are an unsafe and unnecessary harbor into which to navigate Santee Cooper.