In South Carolina Port Case, Court Caves to Organized Labor

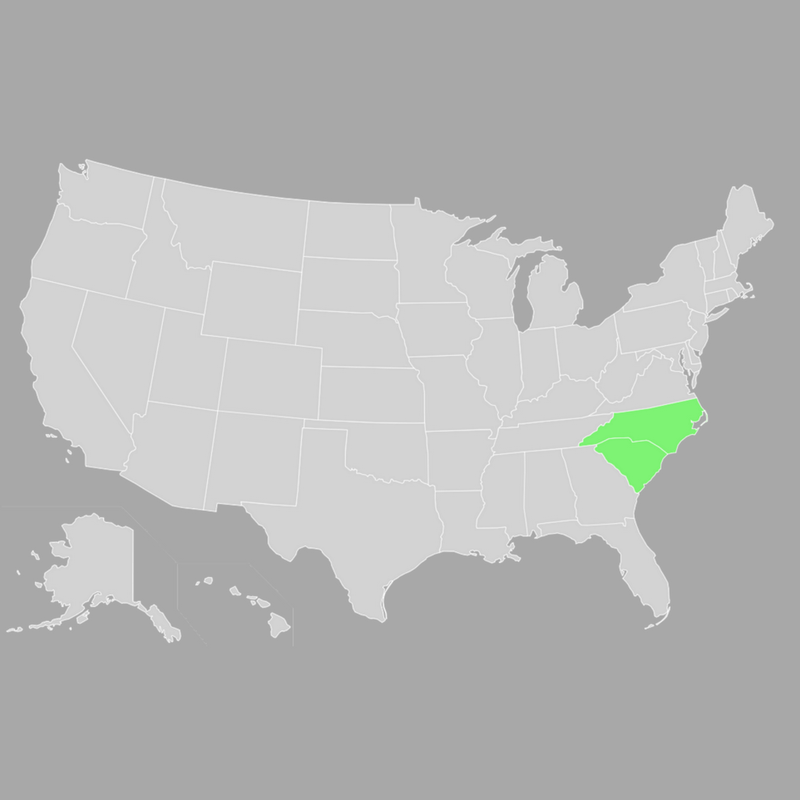

The Fourth Circuit Court of Appeals is seated in Richmond, Virginia. It hears appeals from the nine federal district courts in South Carolina, North Carolina, West Virginia, Virginia, and Maryland. In the past, the Fourth was a happy home for originalism, federalism, and free enterprise. Now? Not so much. Just last week, the court essentially