The Gig Economy’s Healthcare Crisis

The Rise of Gig Work

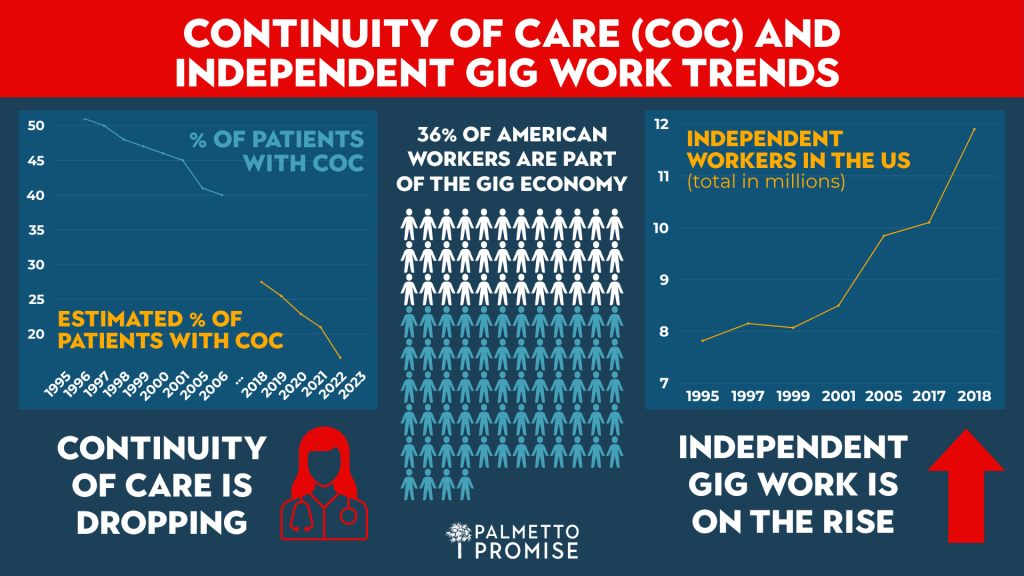

As work becomes more flexible, healthcare becomes more fragile. Today, over one-third of the American workforce (36%) earns a living through the gig economy, a system based on contract or “gig”-based work, often facilitated by online platforms (think Uber, Lyft, Airbnb, VRBO, Grubhub, Doordash, Fiverr, Thumbtack, Etsy etc.). This sweeping shift is redefining how we work. For wage-earners, contract-based jobs offer freedom: flexible schedules, autonomy, and varied career paths. For businesses, gig work is a tool for navigating the volatility of a fast-changing economy.

But beneath the surface of this flexible model lies a growing crisis: Around 50 million independent workers do not have consistent access to healthcare. At the heart of this growing problem is one critical issue: continuity of care.

What is continuity of care, and why does it matter?

Continuity of care (CoC) refers to the consistent, ongoing management of a patient’s health over time. It has two main components: relational continuity (the bond with a healthcare provider) and informational continuity (complete charts, medical history, etc., which follow the patient). Together, these create a strong foundation for quality healthcare.

The evidence-based benefits of CoC are wide-reaching and well-documented:

- reduced mortality rates

- fewer hospital admissions and emergency department visits

- reduced health care costs

- increased physician productivity

- better uptake of preventive care

- better medication adherence and more appropriate prescribing

- improved quality of life

- a better patient-clinician relationship

- improved satisfaction for both the patient and the physician

Despite all these benefits, CoC is on the decline. Over the past few decades, shifts in the American healthcare system have made long-term relationships between patients and providers harder to maintain. Concerns about weakening continuity of care have grown both in the United States and beyond. We have recently written about the chipping away at patients’ continuity of care represented by physician non-compete agreements.

Over time, some changes are inevitable, of course. People move, needs change, and care relationships end. But continuity doesn’t have to disappear when a provider changes— careful transitions that preserve medical continuity are becoming increasingly relevant. Transitions that take a continuity-focused approach are ideal for this variable environment.

Still, not everyone has equal access to this kind of support. Independent workers, in particular, often lack stable insurance and a regular provider, making their care more fragmented from the start. In a system where continuity is already eroding, they are among the most at risk.

Independent Contractor data comes from the US Bureau of Labor Statistics. See data here and here. Continuity of care data is from here. The estimated continuity of care data from UK studies (2018-2022) and is likely a slight underestimate, as shown in previous comparisons with UK data. See more data evidence of declining CoC here, here, and here.

The Solution to the Crisis

Gig workers, such as ride-share drivers, delivery workers, rental hosts, and independent contractors, do not typically receive traditional job benefits. This is because offering employer benefits may trigger the legal employment test, reclassifying independent gig workers as employees.

One fix for this problem is the concept of portable benefits. With portable benefits, savings accounts are created that move with workers from job to job, allowing independent workers to access healthcare, retirement plans, or paid leave without being tied to a single employer. Instead, contributions can come from multiple hiring entities into one central, worker-owned account.

Importantly, portable benefits do not replace an employer’s legal obligations for workers’ compensation coverage or state unemployment security, and employer contribution to these accounts is not required. They are a means of voluntary contribution that the majority of voters (61%) support for gig workers. Employers like DoorDash may choose to offer contributions to portable benefit accounts as a way to recruit and retain employees and improve company reputation.

A Market-Based Case for Fixing the Continuity Crisis

Portable benefits and CoC deserve attention from policymakers. When CoC is lost, the result is often more emergency visits, higher costs, and missed opportunities for early intervention. This drives up healthcare spending for everyone, including state governments. Addressing the CoC problem with portable benefits means upholding the free market, not expanding bureaucracy. Portable benefits offer a deregulated, market-based solution: removing barriers keeping people from consistent care, empowering workers who feel stuck to a job with benefits and allowing employers to contribute voluntarily. This free-market fix has the power to drive down costs, improve outcomes, and make the system more efficient.

Policy in action: What are other states doing?

The rise of gig work presents a policy dilemma, requiring legislation in this area to strike a delicate balance between two priorities: meeting the healthcare needs of independent workers and accommodating the economic constraints of employers. On one hand, strengthening access to care enhances continuity and stability for gig workers who often lack traditional coverage. On the other hand, thoughtful policy can empower employers to extend benefits without sacrificing the flexibility that defines contract-based work. And most importantly, portable benefit legislation needs to expand options, but not place more regulations on employers or gig workers.

Several states have taken steps to address this issue. Utah, Tennessee, Alabama, and Wisconsin were the first states to tailor their legislation to the emerging gig economy.

- In 2023, Utah enacted SB233, creating a legal exemption that allows voluntary contributions to portable benefit plans without affecting workers’ classification. Gig workers have access to essential benefits while maintaining their independent status.

- Tennessee followed with companion bills, SB1377 and HB494 (The Voluntary Portable Benefit Plan Act), which allow similar voluntary contributions and clarify that such benefits do not impact employment status.

- Alabama passed SB86, mirroring the models of Utah and Tennessee.

- Wisconsin’s AB269, which has passed both houses and is now on its way to the Governor’s desk, also mirrors other states’ models.

These state efforts retain the central goal of preserving the flexibility that defines gig work while improving healthcare outcomes. Beyond these statutory reforms, our neighboring state of Georgia is testing a similar pilot program.

South Carolina’s Opportunity

Portable Benefit Plan Acts by several states mark real progress, but gig workers in most jurisdictions still lack access to these options. South Carolina now stands at a crossroads. By enacting portable benefit legislation, the Palmetto State can support its most adaptable workers while helping rebuild continuity in a fragmented system.

It’s time to lead. South Carolina can be a place where portable benefits ensure that independent work doesn’t mean disconnected care.