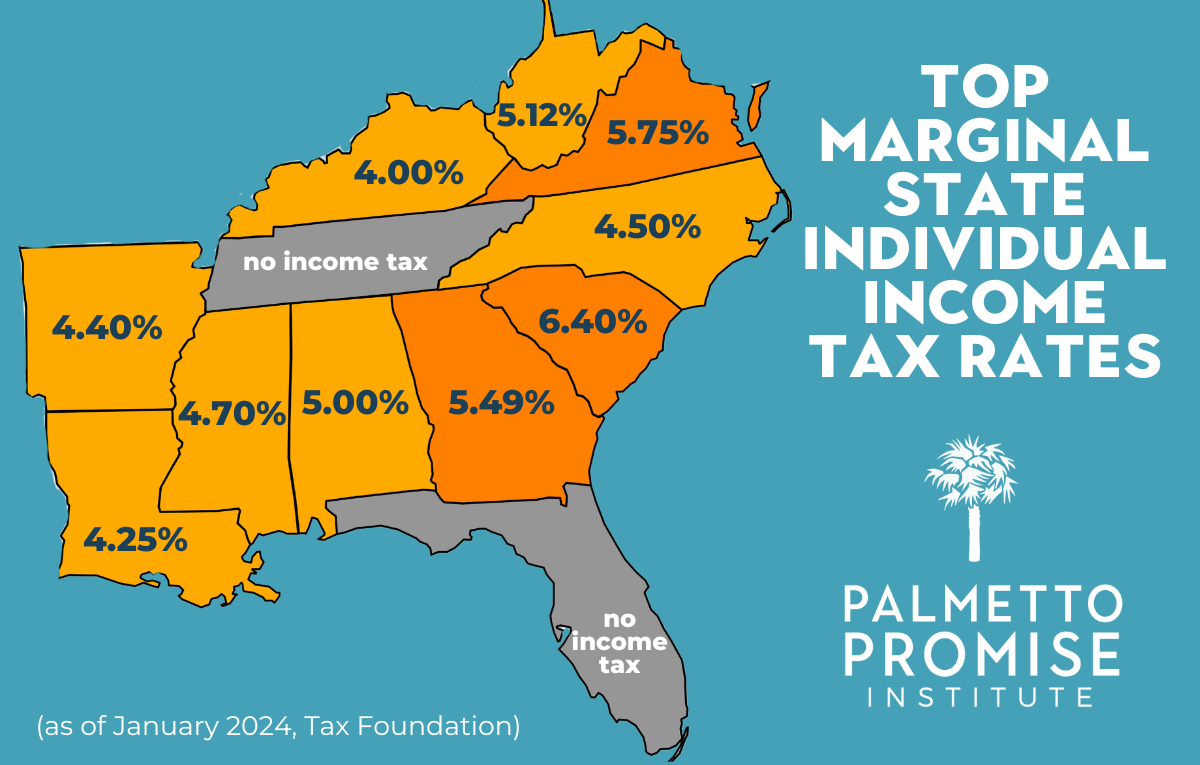

NATIONAL REVIEW: South Carolina Quietly Fixing Its Tax Problems. A blue state or two could learn from our example.

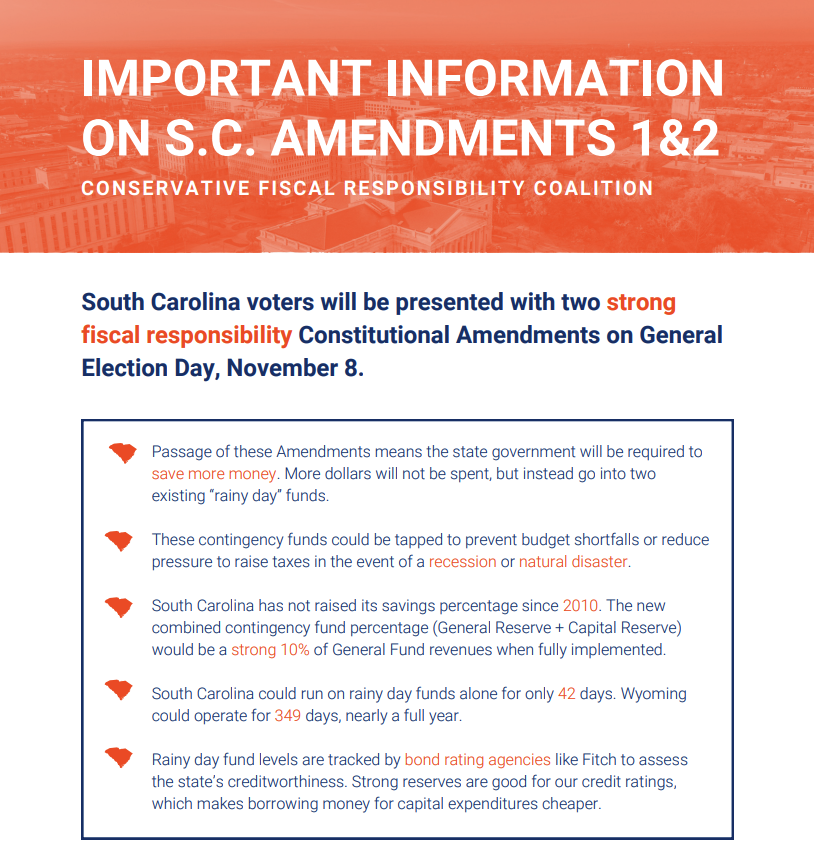

This op ed by Palmetto Promise Senior Fellow Dr. Oran Smith was originally published in the National Review, July 23, 2024. Because South Carolina wisely resisted total lockdown during Covid, coming out of the pandemic, we were in a good position. But on fiscal issues, state leaders had been content to kick the can down