The myths about selling Santee Cooper

This article was originally published in The State and was written by PPI’s Dr. Oran Smith.

State-owned utility Santee Cooper has a long, rich history. It was Santee Cooper that literally sent light into darkness, bringing power to our rural communities at a time when no other utility would take the risk. Unfortunately, the more recent chapters of the agency’s story are less inspiring.

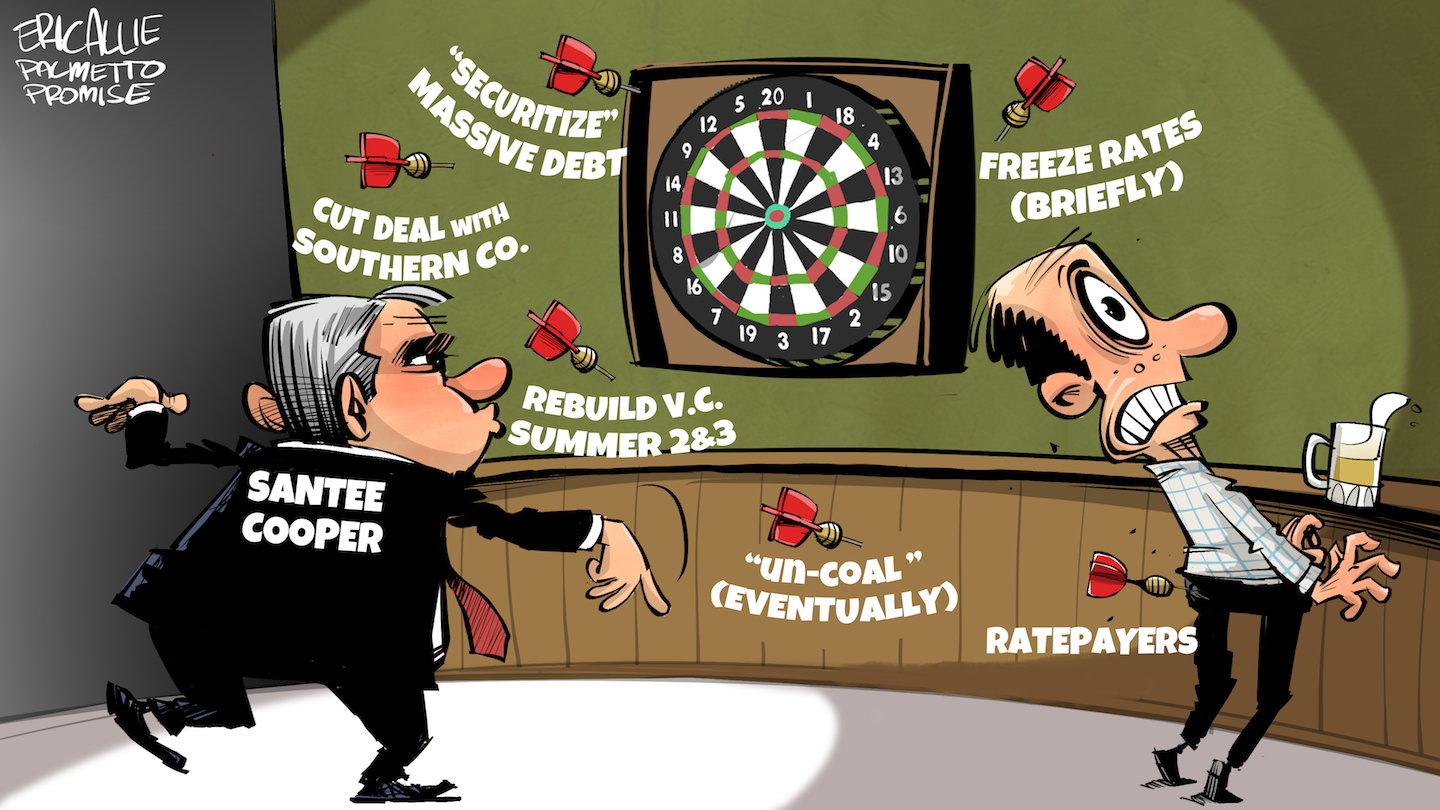

But with the SCANA issue settled, our state appears to finally be ready to deal with what a key state senator last week called “the bigger gorilla,” Santee Cooper. The legislative Public Service Authority Evaluation and Recommendation Committee approved a number of critical elements to field and evaluate sale offers for the utility, also agreeing to accept proposals for “new management.” With this option, an outside company would bid to take over the day-to-day operations of the utility rather than buying Santee Cooper outright.

Palmetto Promise Institute has worked with economists to determine the impact of Santee Cooper’s debt on its customers, who are the state-owned utility’s only source of income. They are currently on the hook for right at $15 billion in principal and interest. We won’t mince words — a change in “management” won’t make a dent in $15 billion. No matter how one manages it, Santee Cooper’s customers will still be paying for their utility’s mistakes.

Lest the committee and the South Carolina public be dissuaded from the proper course of action, here are a few common myths that have arisen in this debate:

Myth 1: If Santee Cooper goes private it will cost the state a fortune in lost fees. If Santee Cooper is purchased by a private company, the state would lose the fee that government-owned Santee Cooper pays annually. Fact: Yes, but that loss would be more than offset by taxes that investor-owned utilities pay.

Myth 2: Santee Cooper is doing all it can to minimize its debt. Santee Cooper has made barely a dent in its V.C. Summer debt principal. Fact: The utility is artificially keeping rates down for now, likely to avoid more public outcry from its customers. This means more debt and higher rates for customers down the road.

Myth 3: Santee Cooper will need to raise rates only a little to pay off V.C. Summer debt. Santee Cooper originally suggested that only a small series of rate increases would be required. Fact: Actual calculations show an increase of 12.2 percent to 13.7 percent by 2024.

Myth 4: Bond agreements represent a huge roadblock to a sale. Fact: The state of South Carolina will have the ability to negotiate settlements with the bond trustee for Santee Cooper and it is common sense that they would be receptive to any reasonable proposal that assures repayment of the bonds.

Myth 5: A sale could lead to Lake Marion and Lake Moultrie being drained. Fact: For many reasons, including the worth of the hydro-generated electricity and the possibility of state management of the lakes or a requirement of the state for a new owner to continue lake operations, this is highly unlikely.

A lack of oversight caused Santee Cooper’s current catastrophe. Hiring a “manager” to answer to a Board of Directors that is already muddled with confusion over its leadership is fraught with danger. We urge the Evaluation and Recommendation Committee not to be dissuaded by that myth, or by the others we identify here.

Oran P. Smith, PhD is Senior Fellow at Palmetto Promise Institute.