A Rainy Day Update

How does the Palmetto State stack up against the other 49 in terms of saving for fiscal catastrophes, both with emergency budget set asides and budget surpluses?

How does the Palmetto State stack up against the other 49 in terms of saving for fiscal catastrophes, both with emergency budget set asides and budget surpluses?

PPI senior fellow Oran Smith is quoted in this Center Square article on the South Carolina state budget. (The Center Square) – The South Carolina General Assembly adjourned its 2021 regular session last month but lawmakers will return to Columbia on June 8 for a special session to allocate as much as $5 billion in

The House is slated to return for a budget session on Tuesday, June 8, and there will be lots of candy in the window. Just look at what the budget writers have to play with for the fiscal year beginning July 1, 2021.

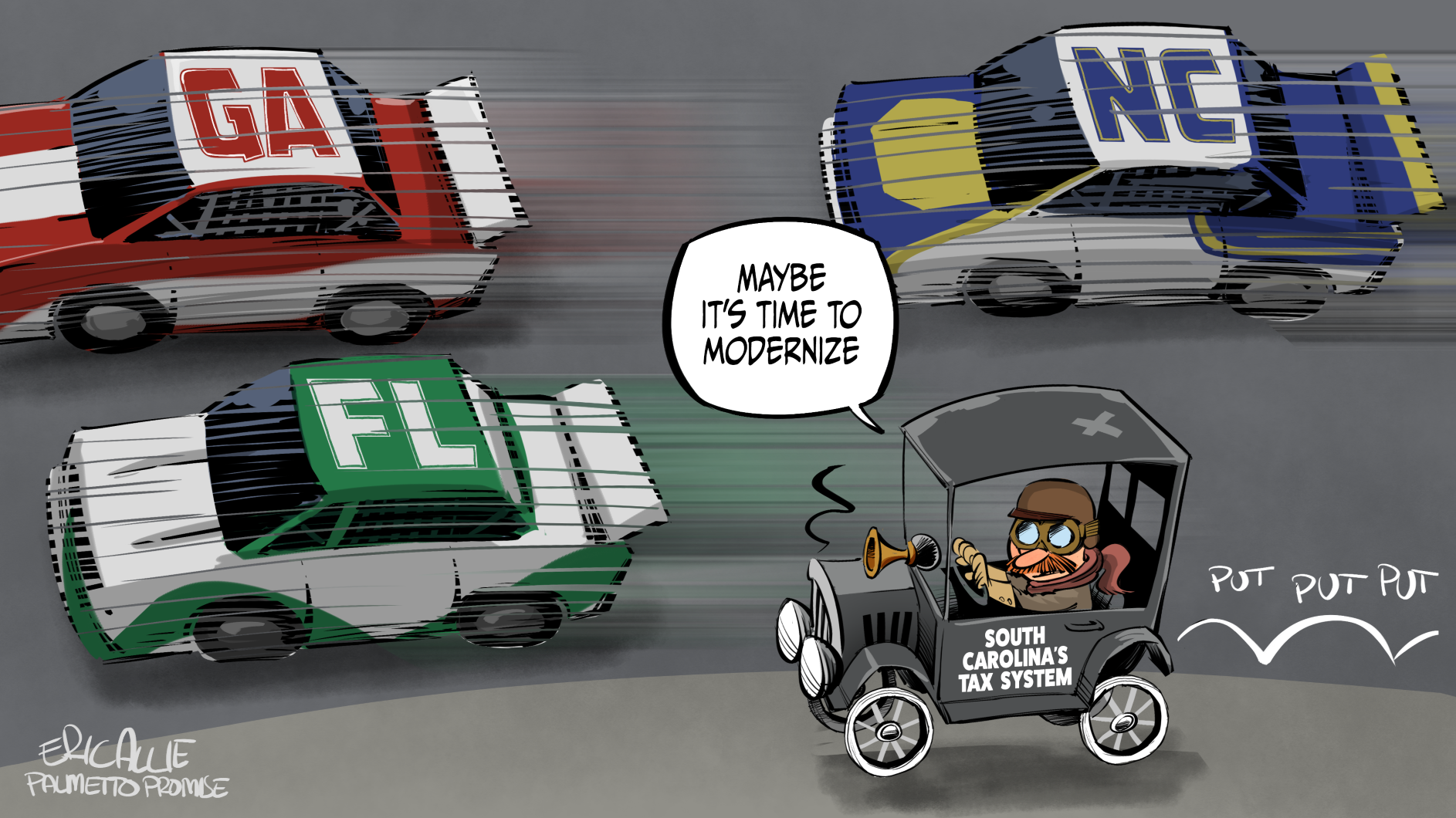

South Carolina is among the nation’s top magnets for new residents in recent years because the Palmetto State is a great place to live. Yet South Carolina’s outdated tax code holds the state back in the national and global competition for new business, jobs, investment and people.

As Tax Day rolls around once again, Palmetto State residents are painfully reminded that—when compared to our Southeastern competitors—South Carolina currently takes home the trophy for "highest personal income tax rate"... a whopping 7%. Meanwhile, our neighboring states have been on the move to modernize their tax systems.

PPI President and CEO Ellen Weaver is quoted in Center Square regarding PPI’s priorities for the 2021 legislative session. (The Center Square) – South Carolina lawmakers will return to Columbia on Tuesday to begin the 2021 legislative session, and more than 800 pieces of legislation already have been filed for the General Assembly to consider.

Tax Low + Spend Smart = Jobs & Growth These recommendations are drawn from the Palmetto Promise Playbook report. You can view our policy agenda for other issues by clicking below. Education | Energy | Healthcare | Work, Justice, & Quality of Life TAX REFORM & FAIRNESS Implement the findings of the comprehensive analysis conducted

As South Carolina budget writers continue to warily watch COVID-19’s impact on state revenue projections, what better time to take a look at how South Carolina generates tax revenue. Tax economists generally advocate for a “3-legged” stool of taxation, a balanced combination of income, consumption (sales), and property taxes, to create revenue stability across the

We hope this message finds you safe as South Carolina slowly but surely moves towards the “next normal.” Governor McMaster has now allowed indoor restaurant dining and has set a date of next week for the opening of close-contact businesses like hair and nail salons. We’re encouraged to see folks able to get back to work

In a matter of days, broadband connectivity went from being a luxury to a virtual necessity. Millions of adults suddenly found themselves working from home and students moved to learning online practically overnight. For many individuals, the only way to see their doctor is through telemedicine. While some communities across America have the internet infrastructure